And while true that the REIT’s leverage ratio of 6.7 is higher than the average REIT’s 5.8, the interest coverage ratio of 3.5 is still safely in line with the sector average (3.4). That’s why Kite has a BBB- (investment grade and stable) credit rating that lets it borrow at 4.1% (89% long-term fixed-rate bonds). 4.1% borrowing costs are less than half the returns on capital its investments are generating, showing that Kite is able to grow profitably. In fact, thanks to its high retained cash flow (low payout ratio) even after asset sales are finished in 2019 the REIT will still be able to fund all growth with retained FFO alone. Management expects that positive FFO growth will return in the second half of 2019 and by 2020 the REIT will be growing at its historical rate.

That means that in addition to a safe 7.9% yield, investors can expect long-term dividend growth of about 4% as well. Factor in multiple expansion and that translates into a nearly 18% CAGR total return over the next decade. That’s double the market’s historical return and makes Kite Realty a potential retirement maker.

Why is Kite likely to generate such amazing returns? That would be one of the lowest valuations in the sector. There are many ways to value a stock but for REITs, two are most useful. The first is to look at the Price/FFO ratio, which is the REIT equivalent of a PE ratio.

- Price/FFO: 8.1 (sector average about 16.5)

- 13 Year Average P/FFO: 12.4

- FFO/Share Growth Rate Baked Into Current Price: -0.2% (4.3% actually likely)

Today Kite trades at half the sector average, and 35% below its 13 year average (since IPO). That means that today’s price is baking in 10 years of -0.2% annual FFO/share growth. In reality management, analysts, and I, expect 4.3% growth. With such a low bar to clear, if Kite can grow at all then its P/FFO ratio will rise, its yield will fall, and investors will enjoy a very strong valuation boost. How strong? Well, that’s where the most useful dividend stock valuation method comes in. That would be dividend yield theory or DYT.

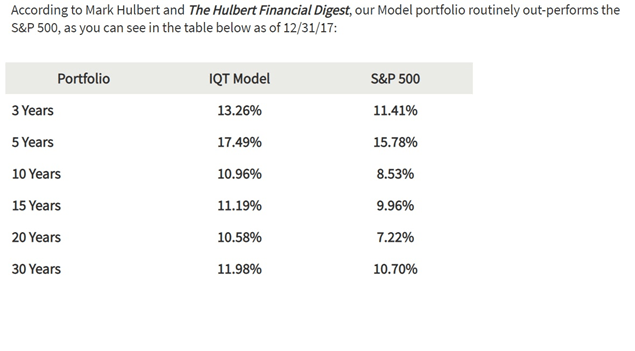

Since 1966 asset manager/newsletter publisher Investment Quality Trends has been exclusively using this valuation approach to generate decades of market-beating returns (with 10% lower volatility to boot).

(Source: Investment Quality Trends)

About the Author:

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!