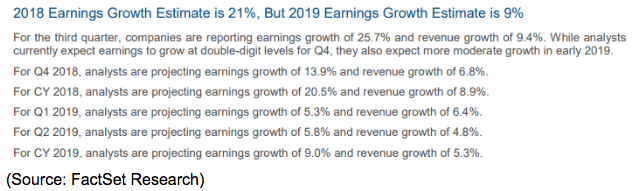

On top of that analyst earnings forecasts for 2019 earnings growth are rapidly declining, from a high of 10.4% a few weeks ago, to just 9.0% today.

Add it all up and you have the makings for a “risk off” scenario in which even objectively good fundamentals are ignored in favor of worrying about what might happen next year. So how can investors protect themselves from the bears currently running wild on Wall Street?

How To Protect Your Portfolio When Wall Street Runs Deep Red

History is very clear that the best way for you to lose money is to panic sell during times like these. Thus to help you stay calm and avoid making a potentially costly mistake, here are three things to remember about Wall Street’s current fears.

First, the US economy is NOT likely headed for recession anytime soon. That’s based on my weekly tracking of no less than seven leading meta-analyses of leading economic indicators and economic models in my weekly economic updates.

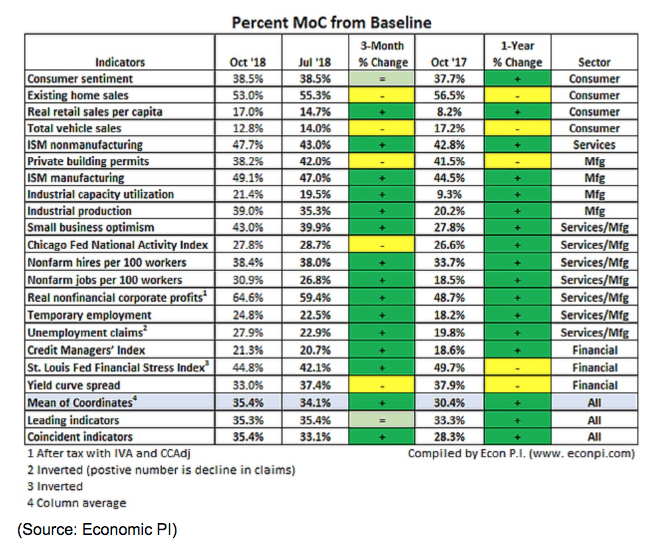

The most important one is the 19 leading economic indicators which have historically proven to trend downwards long before the US enters a recession. Today 16 of those indicators are signaling continued growth and the trend in most of them, both short-term (three months) and long-term (one year) is firmly positive. Yes, the economy is slowing, possibly due to the trade war. BUT the fundamental health of the economy, indicated by so many positive leading indicators, shows that a recession isn’t likely to be followed by the slower growth that most economists (and the Fed) expected to happen next year. In other words, slowing growth in Q4 is NOT a surprise and is precisely what we expected to happen.

About the Author:

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!