Options Trading: Profit and Probability Discussion [Part 2]

In the [first part of this series], we discussed how returns need to calculate returns on a risk-adjusted basis in both percentage and dollar terms. This applies to within the context of each position but, the overall portfolio. Now, let’s take a look at how setting up the proper risk/reward profile for each individual position will boost overall profitability.

Winning Percentage

A big secret that many rich traders know that new traders do not is that the winning percentage for even the best traders is only about 50%-60%. Having big winning trades and small losing trades is their edge.

Big losses will kill your account quickly and small wins will do little to pay for those losses. Our trades have to be asymmetric where our downside is carefully planned and managed, but our upside is open-ended. This is a crucial element for trading success and has to be understood and planned for. Consider the following sets of risk/rewards with win rates.

- With a 1:1 risk/reward ratio and 50% win rate a trader breaks even.

- With a 2:1 risk/reward ratio and about a 35% win rate a trader breaks even.

- With a 3:1 risk/reward ratio and about a 25% win rate a trader breaks even.

The risk/reward ratio is used by more experienced traders to compare the expected profits of a trade to the amount of money risked to capture profit. This ratio is calculated mathematically by dividing the amount of profit the trader expects to have made when the position is closed (the reward) by the amount the trader could lose if price moves in the unprofitable direction and the trader is stopped out for a loss.

Don’t Play the Lottery

One of the biggest mistakes novice options traders make is buying way out-of-the-money calls. These options through their typically-low dollar cost seemingly set up a great risk/reward profile. You can only lose what you pay for, the option and profits are theoretically limitless.

I refer to these as lottery tickets because you are much more likely to rip them with a 100% loss than you are to hit the jackpot. And remember, these options come with an expiration date, meaning you not only need an outsized price move, but it has to occur within the right time frame.

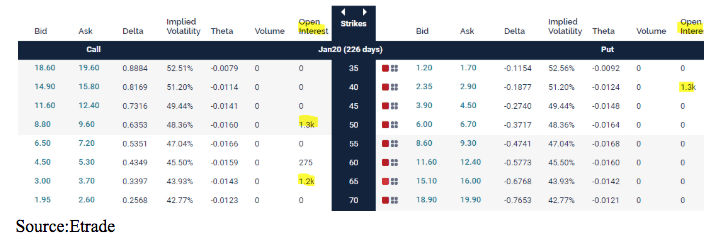

In addition to these OTM options having a low probability of success, they also may not be as “cheap” as they seem. In options, it’s not just the dollar amount that determines whether it is relatively cheap or expensive, it is the implied volatility. Often, the implied volatility on these OTM is very high-causing inflated premiums. This is especially true, ahead of pending news such as earnings or takeover chatter when the lottery aspect of these come fully into play.

Three-Step Approach

In setting up a trade, I take three basic steps:

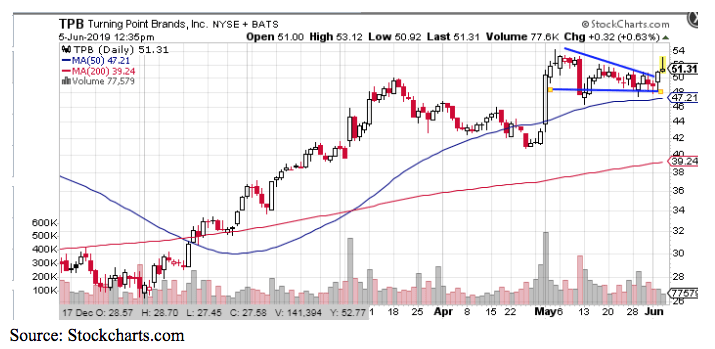

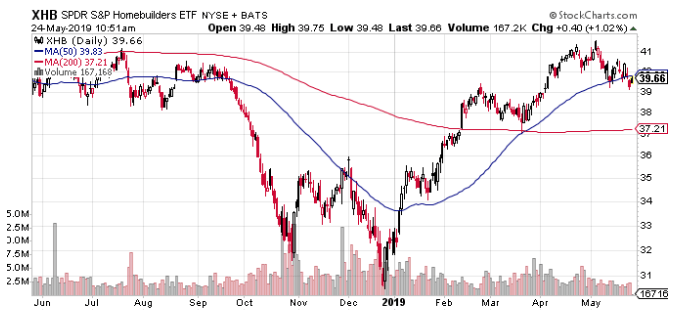

1. Use the chart to find an attractive entry level and define your trade parameters. This means buying near support and selling at resistance levels. This not only provides an attractive initial price but helps you set a realistic price or profit target. It also limits risk, if support is broken, the position gets closed for a small loss. Ideally, the price target should be at least twice the price magnitude as the stop loss level.

2. Choose a strategy that will deliver at least a 2:1 risk/reward if the price target is achieved. If the target is small and the stop is tight, one can simply buy an at-the-money call. If the parameters are wider than using a spread might make more sense.

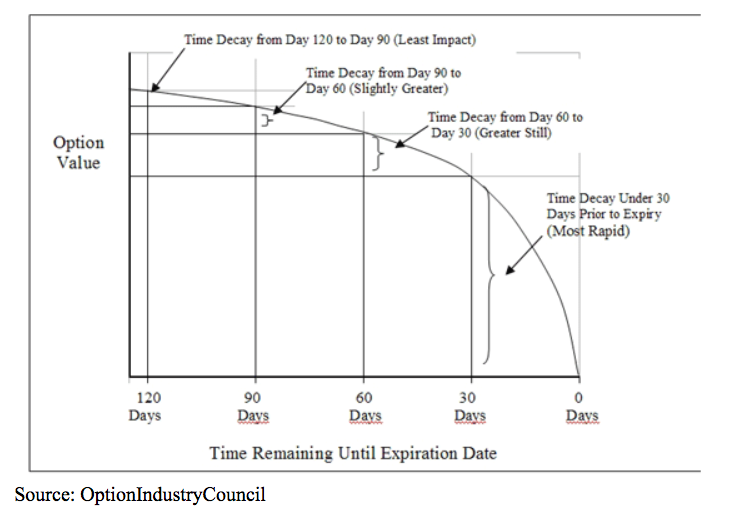

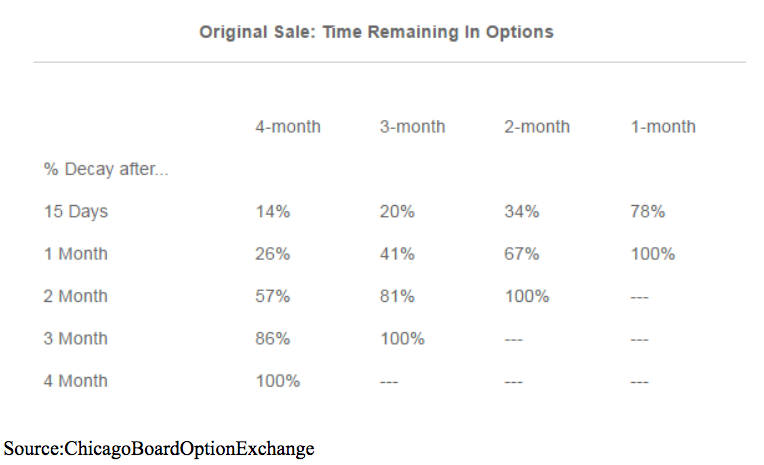

3. Allow sufficient time for your thesis to play out. If this a turnaround story, you’ll want options that have an expiration that is at least 8-12 months away. If you just looking for a quick technical bounce or an earnings announcement using a shorter term of options, anywhere from two weeks to three weeks makes, will provide better returns.

The bottom line: Managing risk is more important than trying to always be right.

.

.