Stocks took a scary dip last week, but no technical indicators were broken and the bullish bounce still seems in effect. With this in mind, I’m looking to add a bullish position in a couple of individual names while overwriting them with a bear call spread in the “Nasdaq (QQQ - Get Rating)” as a means of both hedging and collecting short term premium.

As I mentioned in last Friday’s article , the generals, better known as FAANG or the big five, those being Apple (AAPL),” “Microsoft (MSFT),” “Amazon (AMZN),” and “Alphabet (GOOGLE)”, which now represents 42% of the QQQ, cannot continue to lead the indices much higher without the middle-level soldiers following.

With that in mind, I hunted for some names that I believe have upside but wanted to sell a QQQ bear call spread to create a customized “overwrite or covered call to my portfolio, which provides a slight hedge and helps mitigate adverse headwinds inherent to options such as theta decay.

The first name I added was “SPDR Biotech ETF (XBI) “ it’s comprised of names such as “Regeneron (REGN)” and “United Therapeutics (UTHER)” but none of the over 122 names account for more than 3.5% weighting. It’s a field bet on the smaller biotech stocks. And right now, it’s hot for the obvious reasons; COVID and gambling on COVID.

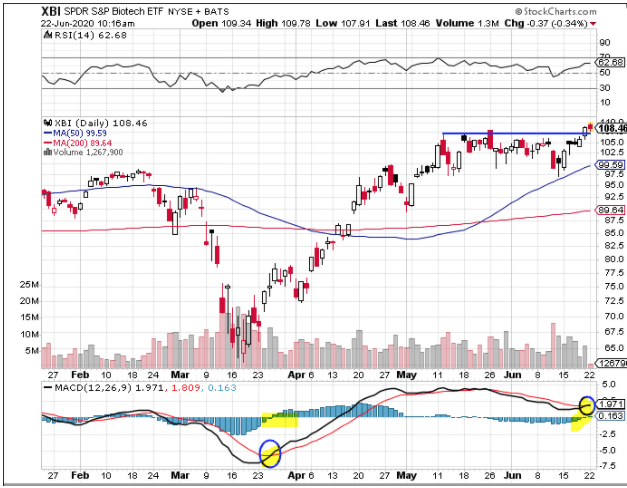

The ETF has been strong, pushing to new highs on Friday and holding steady above $106 support today. I don’t often show technical indicators on the chart, but you can see RSI on top is trending higher and on the bottom panel the MACD is ready for a crossover bullish signal.

This is the position I established on Friday; it is a diagonal spread. Buy to open 1 contract XBI July (7/17) 105 Call and Sell to open 1 contract XBI July (7/02) 110 Call for a Net Debit of $4.25, It does well through an increase in price and time decay.

The second position I established on Monday was in “Slack (WORK)” which is a provider of collaborative workplace software, suffered a big sell-off following its June 4th earnings report, losing some 25%. The numbers were not terrible; new paying customers grew 32%, revenue grew 50% and margins increased. The sell-off was probably a combination of profit-taking, the stock has gained 50% in the 3 weeks leading to the release as a favorite ‘work from home’ play’ and expectations were off the charts. Also, there are acknowledged legacy tech competitors, notably Microsoft with TEAMS, bringing a lot of fire-power.

But Slack CEO, Stewart Butterfield seems like a sharp and transparent operator ( I have a slight man-crush on him) has wisely made deals with MSFT and others to allow cross access to the platforms. As COVID reasserts itself, the WFH (or any way) is becoming a digital fixture of the workplace. Unlike “Zoom (ZM)”, whose video-dominant platform allows people to ‘get things done’ under less than optimal circumstances, Slack’s offering is actually a tool for boosting productivity under any circumstances. Following the post-earnings plop, the chart shows the stock has held the $30 level support level very well. This gives a nice risk/reward entry point.

The strategy here was also a diagonal spread which consisted of; -Buy to open 2 contracts WORK August (8/21) 29 Calls and Sell to open 2 contracts WORK July (7/17) 34 Calls for a Net Debit $3.10. Lastly, today I sold a bearish call spread in the QQQ on the notation the above mentioned big five are simply running into an exhaustion level.

The particulars of the trade are; –Buy to open 2 contracts QQQ July (7/10) 253 Calla and Sell to open 2 contracts QQQ July (7/10) 251 Call

For a Net Credit of $0.60. I think these three positions are poised to benefit over the next few weeks and provide a nice balance of directional exposure while minimizing the headwind of time decay.

To learn more about Steve Smith’s approach to trading and to access his Option360 program, click here.

Want More Great Investing Ideas?

9 “BUY THE DIP” Growth Stocks for 2020

Is the Bull S#*t Rally FINALLY Over?

7 “Safe-Haven” Dividend Stocks for Turbulent Times

Top 3 Investing Strategies for 2020

SPY shares were trading at $307.00 per share on Tuesday afternoon, up $2.54 (+0.83%). Year-to-date, SPY has declined -3.63%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |

| QQQ | Get Rating | Get Rating | Get Rating |