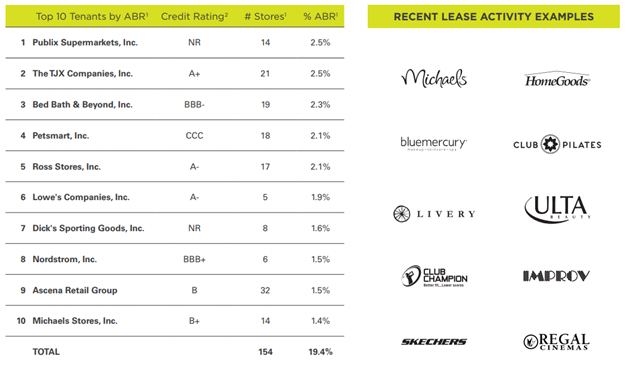

The REIT is also highly diversified, with even its top 10 tenants making up less than 20% of annual rent, and most of that from thriving retailers.

(Source: investor presentation)

Today 70% of new leases are signed with restaurants, service providers (like gyms), and other e-commerce resistant businesses. Combined Kite’s long-term leases with these retailers provide it with very stable cash flow (what REITs calls FFO or funds from operation) to pay its dividend, which currently yields a mouthwatering 7.9%. But a safe 7.9% yield is just one reason I bought this stock so aggressively during the worst month for stocks in 7 years.

Why Wall Street Hates The Stock But Why This Safe 7.9% Yielding REIT Could Make You A Fortune

Since mid-2016 Kite Realty is down a staggering 47% from its all-time high. Why has Wall Street hated this stock for over two years? Well REITs, in general, are in a bear market since long-term interest rates (10 year-yield) has risen from its all-time lows (which put REITs in a bubble).

Add to that the fact that the market’s obsession with the “retail apocalypse” has soured investors on retail REITs in general, and you get a badly beaten down share price. However, there’s one more reason Kite is so unloved right now.

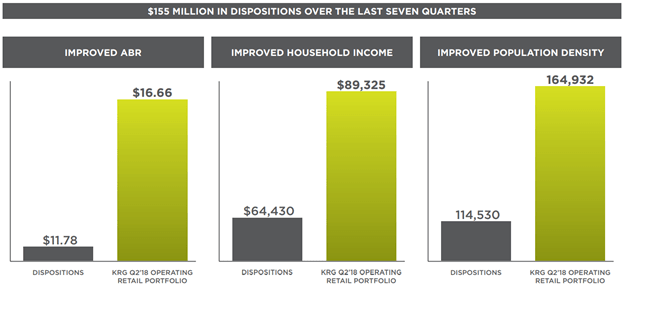

That would be because in 2017 management, led by 21 year company veteran John Kite (CEO since 1997, before it IPOd), initiated a three-year company restructuring plan. This called for about $255 million in asset sales (dispositions).

(Source: investor presentation)

About the Author:

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!