After five years as a professional analyst and investment writer, I’ve learned a great deal about market history and investing theory. I’ve personally applied that information to my own retirement portfolio (where I keep 100% of my life savings), which has seen steadily improving returns the more I put into practice the most time tested and proven long-term investing techniques.

Today I’d like to point out three reasons why good diversification is one of the most important, easiest but most overlooked ways to boost your portfolio’s returns. So let’s take a look at why diversification works, and more importantly, how you can use it to enhance your investing results and hopefully achieve your financial dreams.

Good Diversification Will Help Your Avoid Losing Lots of Money

Warren Buffett famously said there are two critical rules to good investing “Rule No. 1: Never lose money. Rule No. 2: Never forget rule No. 1.”

Now the greatest investor of all time doesn’t literally mean you need to obsess over never being wrong. After all, Buffett himself has admitted to making plenty of mistakes, including a years-long failed investment in IBM. And let’s not forget that Berkshire Hathaway’s investment in Kraft Heinz hasn’t exactly been going well lately (Berkshire just had to write down $3 billion after admitting to overpaying for that merger).

What Buffett is talking about is good risk management, with a strong emphasis on preservation of capital. In other words, while the stock market is historically the best way to exponentially grow your wealth over time, if you foolishly lose too much money, that can hinder your savings’ ability to compound.

And here’s further timeless wisdom from Peter Lynch, one of the few rivals to Buffett’s claim as the greatest investor of all time. Lynch ran Fidelity’s Magellan Fund from 1977 to 1990 and delivered 29% CAGR total returns over this time. That’s in comparison to the S&P 500’s 13.5% annualized returns over that time, meaning that $1,000 invested with Lynch would have turned into $35,340 vs $5,730 invested in the broader market.

“In this business, if you’re good, you’re right six times out of ten. You’re never going to be right nine times out of ten…All you need for a lifetime of successful investing is a few big winners, and the pluses from those will overwhelm the minuses from the stocks that don’t work out.” – Peter Lynch

What Lynch is referring to is the fact that all stocks are “risk-assets” because they have the most potential upside if things go right, but the most downside if management drives the company into the ground.

The worst case scenario is that a company goes bankrupt, in which case the stock goes to zero because shareholders are dead last in the capital stack (the order in which various types of investors get claims on a company’s assets).

Diversification is a critical component to good risk management because no one can know the future, and even the bluest of blue-chips can fail. Just ask investors in Sears or General Electric, both former industry juggernauts who ultimately proved unable to adapt to changing industry conditions and are now either bankrupt or shadows of their former selves.

In fact, General Electric was once a dividend aristocrat, meaning it had raised its dividend for 25+ consecutive years. In 1999 it became the most valuable company on earth before horrible management forced it to cut its dividend three separate times (a total of 97%) and the stock declined 90% from its all-time high.

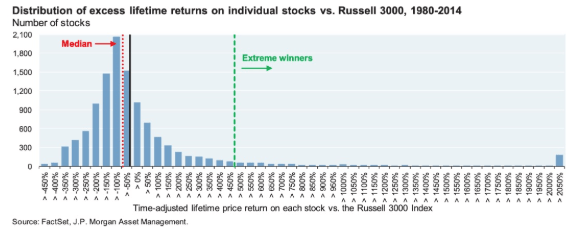

Don’t get me wrong, there is a lot of sense to investing a good deal of your money in blue-chips. A JPMorgan Asset Management study found that between 1980 and 2014 66% of companies in the Russell 3000 (a proxy for the entire US market) not just underperformed the market, but that 40% of companies permanently fell 70+%.

In other words, the historical market data backs up Lynch that a few big winners (the successful blue-chips) are the companies driving all of the market’s impressive total returns over time.

Ultimately investing is like the famous saying “you place your bets and take your chances.” It’s entirely probabilistic in nature. A company with a great corporate culture, wide moat, and industry-leading fundamentals (including a rock solid balance sheet) is LIKELY but not guaranteed to do well over time.

After all, there are lots of competitive advantages proven winners have, including economies of scale and access to low-cost capital that can allow them to invest in growth opportunities with returns on invested capital of two, three, or even up to 10 times their cost of capital.

Such companies, which I strive to point out to readers and invest in myself at steep discounts to historical fair value, are high probability/low-risk opportunities to generate impressive returns as well as lock in generous, safe and growing income over time.

But as Lynch and JPMorgan point out, even the best investors will be wrong sometimes, which is why avoiding an overly concentrated portfolio is a good way to minimize the chance of a disaster at a single company crushing you with a massive permanent loss.

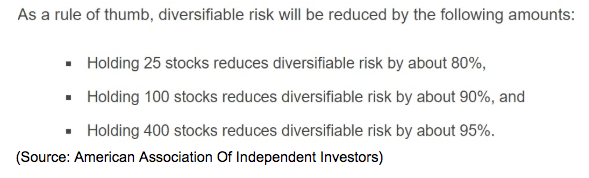

A study by the AAII found that you don’t need to own that many companies to gain most of the benefits of reducing diversifiable risk. For example, owning just 25 companies reduces your risks by 80% while owning 400 reduces it by another 15%. Peter Lynch at times owned as many as 700 companies in the Magellan Fund but 20 to 30 is a good rule of thumb for most actively managed portfolios.

And don’t forget that if you lack the expertise to actively select companies in certain sectors (or at all) then owning index funds is a great way to gain exposure to various asset classes/sectors while achieving instant diversification.

I’m an analyst at Simply Safe Dividends (where I analyze over 200 dividend stocks per year) and here is what we tell our subscribers. Note the following recommendations are from our founder, Brian Bollinger, a former mutual fund manager whose three model portfolios have been beating the market by 1% to 2% annually since our inception in 2015.

- 20 to 30 companies spread out across all sectors (how many SSD’s model portfolios own)

- 5% of portfolio or less in any one company

- 20% or less of portfolio in any one sector

Note that after analyzing my own retirement portfolio’s returns and those of three model portfolio’s I’ve been running to test various investing strategies I’ve adopted the 5% and 20% company/sector caps for my own money.

That’s because these diversification rules of thumb are not just a good way to minimize the risk of loss, but actually, are likely to boost your total returns even if you’re not wrong about a company at all.

Good Diversification Will Actually Improve Your Long-Term Returns

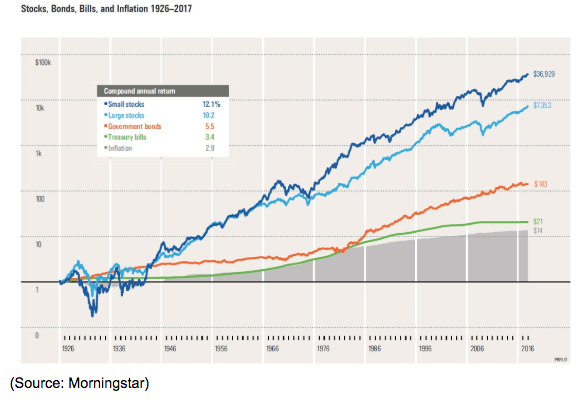

Thus far I’ve described how to diversify a stock portfolio, but the historical data shows that proper diversification also includes overall asset allocation, meaning the mix of stocks, bonds and cash in your entire portfolio.

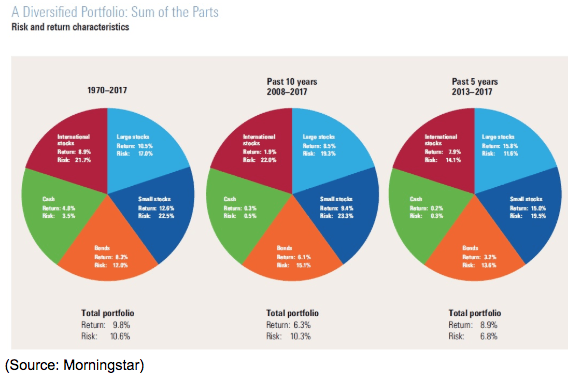

For example, take this model portfolio from Morningstar, which is 60% stocks and 40% cash/bonds. That’s a pretty standard default recommendation that is based on a famous 1994 study from Willian Bengen, the father of the famous “4% withdrawal” retirement rule.

Between 1970 and 2017 this portfolio delivered 9.8% annual total returns compared to 10.6% from the S&P 500 over this time period. But this portfolio’s average volatility was just 10.6% per year while the pure stock portfolio saw an average volatility of 17.1%. This means that on a risk-adjusted basis (total returns/volatility) the more conservative 40% cash/bond portfolio actually outperformed the market by 50% annually over 47 years or an entire investing lifetime.

This highlights one of the most surprising truths of investing, which is that a proven market-beating strategy is low volatility.

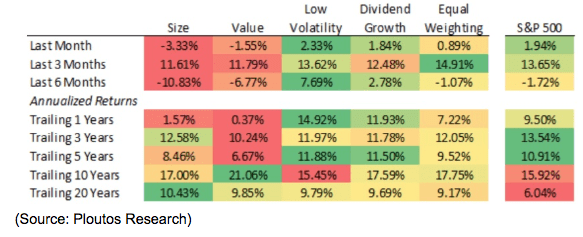

Low volatility investing is one of the five proven “alpha factors” that have been shown over decades to outperform the broader market. That’s because by falling less during corrections and bear markets, low volatility stocks (like utilities and dividend blue-chips) can manage to generate better returns even if they slightly underperform during bull markets.

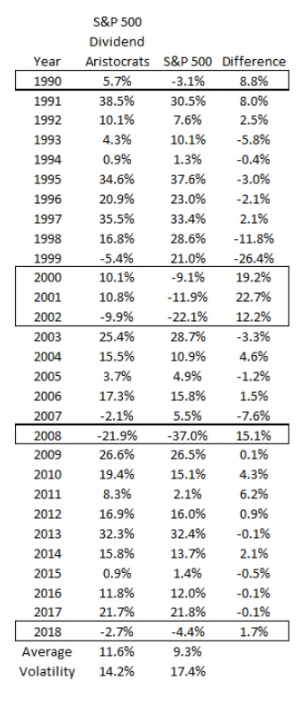

And if you can fall less during the bad market times and keep up with rallies the rest of the time? Well, that’s been the key to the success of the dividend aristocrats.

Since 1990 the aristocrats have outperformed the S&P 500 by 25% annually, with 18% lower volatility to boot. However, it’s precisely because of that lower volatility that this diversified group of blue-chips has been able to outperform so well. Notice that the aristocrats don’t tend to outperform the S&P 500 in most years. They merely keep up with the broader rally. But during bear markets? Their dividend-focused share bases are more loyal and less prone to panic selling resulting in smaller drawdowns from which they need to climb out of once the new bull market begins.

In other words, diversification, both via individual stocks, ETFs and even other asset classes like cash and bonds, is a way to achieve market-beating returns via the much easier approach of falling less during bear markets, and then merely keeping up during the good times.

Or to put another way “offense wins ball games, defense wins championships”.

But speaking of the good times, there is one final very important way that diversification can help you maximize the wealth-building power of the stock market.

Good Diversification Will Help You Maintain Discipline and Avoid Making Costly Mistakes

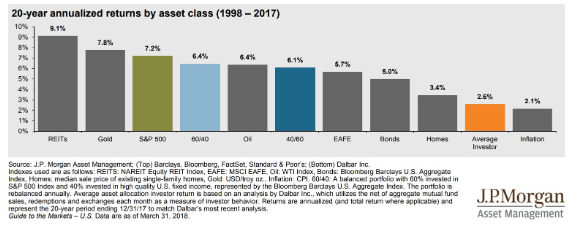

Given the stocks are the best-performing asset class in history some newer investors might make the incorrect assumption that going all into stocks is the best approach to maximizing wealth over time. While that’s true over a long enough period of time, it also fails to take into account human nature and investor psychology.

Psychologists have found that humans have a deeply ingrained bias called “loss aversion” in which it hurts twice as much to lose a dollar as gain a dollar. That is the key reason that actual investor returns are typically so terrible.

The market might be a wealth compounding machine in the long-term, but no one just invests and then goes to sleep for 20 years. Most investors go through periods of panic and euphoria, chasing stocks higher and then panic selling when they drop. Terrible market timing is the reason why the average investor would have earned double the returns being 100% in risk free-bonds between 1998 and 2017, a period that saw two major bear markets and several corrections.

Bonds, while boring and not as powerful in terms of wealth building, are counter-cyclical to stocks, which means they tend to remain stable or rise during bear markets. That ability to reduce losses decrease overall portfolio volatility, and as we have just seen, that in and of itself is a powerful long-term investment strategy.

But diversification via asset allocation into the proper mix of bonds and cash isn’t the only way diversification can help you remain disciplined and avoid making costly market timing mistakes. Diversification, using the 5% and 20% position and sector cap rule of thumb I discussed earlier, is also a great way to stick to a winning strategy over time.

Why does that matter? Well, here’s Peter Lynch to explain the best ways to achieve the kind of returns investors dream of.

“The real key to making money in stocks is not to get scared out of them…Time is on your side when you own shares of superior companies…The typical big winner…generally takes three to ten years to play out.” – Peter Lynch

I’ve made this mistake myself earlier with my retirement portfolio. I initially started out with no sector caps or position limits, figuring that I’d just steadily buy whatever was most on sale for as long as the market was mispricing quality companies at a deep discount to historical fair value.

Here’s the trouble with that seemingly sensible strategy. Sectors can go out of favor for several years, meaning you might end up with up to 60% of your portfolio in one sector (mine was 60% energy with 20% in REITs during that sector’s last bear market).

Even if you’re not wrong about the fundamentals of what you own, owning hated stocks that weigh on your total returns for several years can test the patience of even the most disciplined investor.

But if you cap your exposure to any one sector to 20%, that still allows you to be “greedy when others are fearful” while still owning enough companies in popular sectors that your portfolio is making money over time.

That’s what I’ve concluded after comparing the results of my Deep Value Dividend Growth Portfolio (beating the market by 6.3% after 17 weeks) to my other two model portfolios, which are far more concentrated and have no sector caps. The DVDGP has 20% sector caps and has never been more concentrated than 18% in any single sector (and no more than 3% in any single company).

This diversified portfolio is far more appropriate for most investors, if for no other reason that it’s able to consistently generate great returns which will prevent market envy during times when the market is soaring (like in Q1 2019).

Basically, diversification isn’t just powerful because it helps you minimize permanent losses (capital preservation) but because by smoothing our your returns and being able to at least keep up with the market (as aristocrats have done), it makes it easier to remain disciplined. As Peter Lynch points out, if you own a collection of quality companies then making money is just a matter of time.

But without the patience to let your companies work for you and allow the thesis to play out, achieving great returns becomes far harder, if not impossible. Or as Buffet famously summarized the importance of discipline and patience “the stock market is designed to transfer money from the active to the patient.”

Bottom Line: Good Diversification Is The Simplest, Most Powerful, But Often Most Overlooked Ways To Achieving Better Investing Returns

Good diversification is one of the most important components to successful investing, but sadly it’s one of the least understood and most overlooked. A well-diversified stock portfolio can help you avoid not just a single company disaster like a potential bankruptcy, but also smooth out your returns, and maximize the probabilities that your big winners will more than offset any inevitable mistakes you might make.

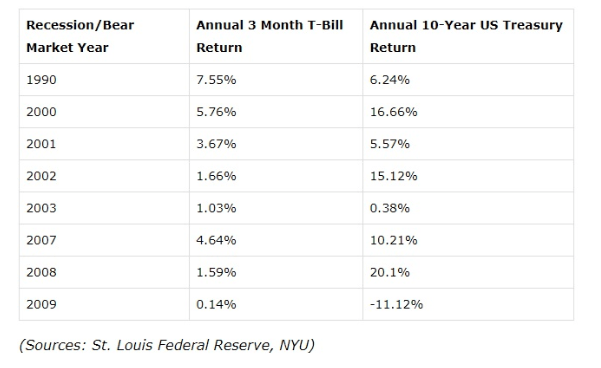

And asset allocation, the diversification into cash and bonds, is what most investors need to sleep well at night (or simply pay the bills) during the market’s periodic and inevitable corrections and bear markets.

A good rule of thumb for most investors is to own enough cash and bonds to pay three years of expenses you might have (factoring in any noninvestment income you may have) to avoid having to sell quality stocks at dirt cheap prices during a recession/bear market.

In terms of your stock portfolio capping positions at 5% for any individual company (such as an equal-weighted 20 company portfolio) and 20% in any one sector, is a good way to minimize regret. Both in terms of not being shellshocked by a black swan event (like financials and REITs going off a cliff during the Financial Crisis) but also more generally, so you can avoid the frustration of a portfolio that’s overweight an out of favor sector.

Never forget that the biggest enemy of good financial decisions is your own emotions and psychology. That includes both fear (panic selling during a correction) and greed (performance envy causing you to jump into “hot stocks” trading at absurd valuations).

A well-constructed portfolio, in terms of stock diversification and proper asset allocation, is the best way to minimize the negative and destructive emotions that could cause you to make the kind of costly financial mistakes that might prevent you from achieving your long-term financial goals.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

9 "Must Own" Growth Stocks For 2019

Get Free Updates

Join thousands of investors who get the latest news, insights and top rated picks from StockNews.com!