- The addressable market for online gambling is growing by leaps and bounds- It’s all about tax revenue

- The pandemic changed gambling behavior

- Penn National (PENN) has soared- The winner in horse racing

- Draft Kings’ (DKNG) franchise is fantasy sports

- Buying DKNG on dips

Companies that combine technology with goods or services people require have done the best in the stock market over the past years. Amazon.com (AMZN) has displaced many retail stores as e-commerce improves time efficiency, pricing, and logistics. Zoom Video Communications (ZM) allows for business and social meetings in the comfort of our homes.

Apple’s (AAPL) products put a high-powered computer, phone, camera, and many other products in our pockets. Facebook (FB) and Twitter (TWTR) launched social media to new heights. These companies have experienced incredible growth and have made many founders and shareholders wealthy beyond their wildest dreams.

Sports are an integral part of our social fabric. Many of us support sports teams in our hometowns and cities. One way to align with the athletes’ interests is to have some action on games and contests. Sports gambling has been around for a long time. Even when it was illegal in many jurisdictions, bookies took bets, creating a massive underground business that funded organized criminal enterprises.

As gambling moves from backrooms and the quiet corners of society into the mainstream, two companies that combine technology with betting are set to become hyper-growth stocks. Penn National Gaming (PENN - Get Rating) and DraftKings (DKNG - Get Rating) are two stocks that could experience exponential market cap growth over the coming years.

The addressable market for online gambling is growing by leaps and bounds- It’s all about tax revenue

The price tag for the global pandemic has been enormous on the federal and state levels. As vaccines create herd immunity to the virus, it will still take months, if not years, for the nation-wide and local economies to return to the pre-pandemic levels.

With deficits rising, taxes are bound to move higher. States previously opposed to gambling are likely to view the activity as a new and significant revenue vertical. We have already seen more and more states legalize online gambling, and that trend is likely to continue as the tax receipts come at a time when the need is far more significant than opposition to legalized betting.

The pandemic changed gambling behavior

Social distancing, working from home, and limiting exposure to the outside world have changed behavior. Over the past months, sporting events occurred in empty stadiums and arenas. Only recently have limited numbers of fans been allowed to attend contests.

There is nothing like being at a sporting event. However, a bet or wager on the outcome or individual performances enhances the experience of watching from home. Sports betting has been popular even when it was illegal. The more states legalize sports and other forms of gaming; the more people will take advantage. Over the past months, we have seen incredible rallies in the shares of two companies that combine technology and gambling. The trends in PENN and DKNG shares are higher, and they may still have a very long way to go on the upside.

Penn National (PENN) has soared- The winner in horse racing

PENN, together with its subsidiaries, owns and manages gaming and racing properties and operates video gaming terminals focusing on slot machine entertainment. The company operates through four geographical segments in the US in the Northeast, South, West, and Midwest. PENN offers live sports betting at its properties in various US states. At the $130.47 per share level at the end of last week, PENN had a market cap of over $20.4 billion.

Source: Barchart

Source: Barchart

The chart highlights that the global pandemic’s risk-off period pushed PENN shares to a low of $3.75 on March 18, 20020. Since then, the move has been nothing short of parabolic, with the stock reaching its most recent peak of $132.76 on March 12 and trading at the high the end of last week.

Draft Kings’ (DKNG) franchise is fantasy sports

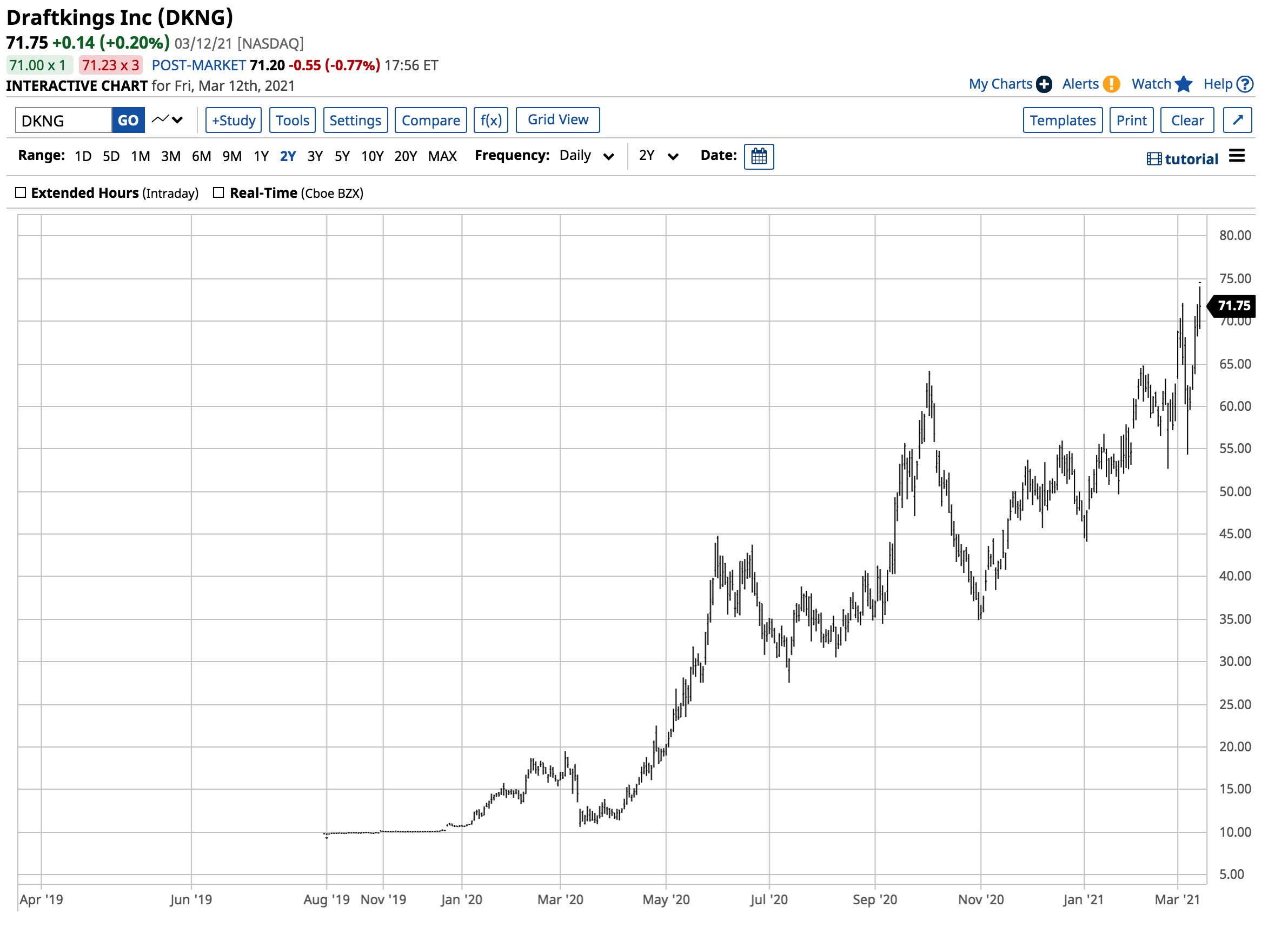

DKNG operates a digital sports entertainment and gaming company via two segments, business-to-consumer and business-to-business. DKNG provides users with daily sports, sports betting, and iGaming opportunities. The company also designs, develops, and licenses sports betting and casino gaming platform software for online and retail sportsbooks and casino gaming products. At the $71.75 per share level at the end of last week, DKNG’s market cap was at over the $28.5 billion level.

Source: Barchart

Source: Barchart

The chart illustrates that after a low of $10.60 per share in March 2020, DKNG rose to a high of $74.09 on March 12. The company recently partnered with the UFC, one of the fastest-growing US sports.

Meanwhile, DKNG has a franchise in the popular fantasy sports sector where users pick among individual athletes in a sport to create teams that compete on performance statistics. Fantasy is one of the most popular gambling segments. It combines the thrill of competition with the skill of picking the right player, making users virtual owners that can profit from decision-making.

Buying DKNG on dips

As of the end of last week, PENN shares had moved over thirty-four times higher since the March 2020 low. DKNG appreciated by nearly seven times since last year’s low. I believe that both companies’ addressable market will grow as tax-hungry states legalize gambling over the coming months and years.

I favor DKNG because of its franchise in the fantasy arena, which takes the thrill of victory and the agony of defeat to a new level. Making fans “virtual” team owners adds a new dimension to sports betting.

Everyone loves a little action on their favorite sports teams and athletes. A wager aligns the fan’s interest with the competitor on the field. While I can see the market caps of PENN and DKNG at many times the current levels, my bet is on DKNG because of its foothold in fantasy sports. Both are growth stocks, but I expect DKNG to catch up with PENN when it comes to share performance over the past year.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

How to Ride the 2021 Stock Market Bubble

5 WINNING Stocks Chart Patterns

DKNG shares fell $2.70 (-3.76%) in premarket trading Monday. Year-to-date, DKNG has gained 48.73%, versus a 5.34% rise in the benchmark S&P 500 index during the same period.

About the Author: Andrew Hecht

Andy spent nearly 35 years on Wall Street and is a sought-after commodity and futures trader, an options expert and analyst. In addition to working with StockNews, he is a top ranked author on Seeking Alpha. Learn more about Andy’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| DKNG | Get Rating | Get Rating | Get Rating |

| PENN | Get Rating | Get Rating | Get Rating |