Hedge funds are often thought of as the “smart money” on Wall Street. At least based on their very high fees (as much as 2% of assets and 20% of profits) investors would hope that they were the smartest guys in the room.

However, often big funds can get into trouble, and create incredible opportunities for regular investors to profit from margin call-induced forced selling.

That’s what happened in mid-March 2020, and it’s what’s happening now.

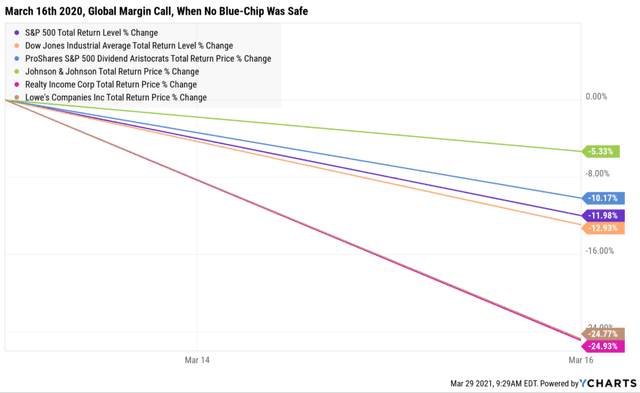

Now it seems reasonable to assume that quality companies can’t fall by crazy amounts as we saw in the panic days of the early pandemic.

- when even dividend aristocrats like Realty Income and Lowe’s fell 25% in a single day

However, the nature of forced selling is that it’s inherently non-rational.

- if a big fund gets a margin call or has to liquidate to meet redemptions, then fire sale prices can be the result

Even in a thriving economy, the best in almost 40 years, individual companies can fall off a cliff.

- Viacom is down 53% in a matter of days

- one of the fastest bubble deflations in market history

So let’s take a look at what in particular is causing one of the fastest stock market crashes (for VIAC), as well as a handful of other popular names such as Alibaba.

Why Certain Stocks Are Falling Off A Cliff

Archegos manages the personal fortune of the former hedge fund mogul Bill Hwang, who won Wall Street’s business despite having pleaded guilty to insider trading years ago. It amassed huge positions in media giants like ViacomCBS and in several Chinese tech companies — largely with borrowed money.” – Dealbook

The hedge fund in question is primarily acting as a private home office to a single billionaire who apparently wanted to speculative with options and derivatives.

The Archegos strategy included using swaps, contracts that gave Mr. Hwang financial exposure to companies’ shares while hiding both his identity and how big his positions really were. (It is also becoming increasingly apparent that several Wall Street banks lent Archegos money without knowing that others were doing the same thing for the same trades.)” – Dealbook

Options and swaps are a way to leverage your bets and are a glorious thing when a stock price is soaring.

(Source: FAST Graphs, FactSet Research)

Mr. Hwang and Achegos must have felt like geniuses leveraging the likes of VIAC, as it became one of the hottest stocks on Wall Street.

Trouble for Mr. Hwang, and his banks, arose when the prices of those stocks started to fall. That prompted some of his lenders to demand cash to cover his bets. When they began to question his ability to do so, some of them, including Goldman Sachs and Morgan Stanley, seized some of his holdings and kicked off the sale of $20 billion worth in huge block trades.” – Dealbook

Of course, leverage cuts both ways, magnifying profits on the way up, but also losses to the downside.

The block sales were $20 billion as of last Friday, $30 billion as of Monday and CNBC is reporting that Wells Fargo is potentially preparing a 17 million share VIAC block sale (about $800 million worth) as I write this on Monday morning.

Block sales are not made on the open market but are private deals usually at a steep discount.

- FactSet Research reports Goldman sold shares of BABA on Friday, March 26th as low as $185, the stock closed at $227 that day

Credit Suisse and Nomura acknowledged being hit especially hard. Credit Suisse told investors that a “U.S.-based hedge fund” had defaulted on its margin calls, which could lead to losses that were “highly significant and material to our first-quarter results.” Nomura said that one of its U.S. arms could suffer “a significant loss” because of the forced sales. Shares in Credit Suisse were down 14 percent this morning; those in Nomura were down 16 percent.” – Dealbook

The results of financing wildly speculative SWAPs and options bets for Archegos have been potentially billions in losses for the likes of Credit Suisse and Nomura.

Some investors are naturally concerned of possible contagion from this single billionaire’s home office potentially triggering cascading crashes throughout global financial markets.

- in 1998 Long-Term Capital Management almost brought down the entire financial system

- The Fed, working with other private banks and financial giants, bailed it out and averted disaster

However, the chances of such a worst-case chain reaction are small.

Goldman, on the other hand, has told investors that its potential losses are “immaterial,” having covered its exposure.” -Dealbook

There are important lessons to learn for Wall Street’s big banks.

Some bankers told The Financial Times that Archegos’s downfall highlighted the risk of one firm taking on so much leverage from multiple banks. (It also raises fresh questions about whether the mania for meme stocks, largely attributed to day traders, was actually fueled by hedge funds jumping into the trading.)

The good news is that we likely won’t face anything close to the LTCM fiasco of 1998. The bad news is, at least for some investors, things might get a lot uglier.

The Short-Term Pain Might Not Be Over

Because of the nature of these derivatives, much like occurred in 2008, banks don’t necessarily know how much exposure Archegos has. Mr. Hwang’s personal assets under management, back when he was managing money in the Asia Tiger fund, was $6.6 billion.

Archegos is managing his personal fortune now and it’s almost certain to be a relatively tiny sum, compared to the global $100 trillion global stock market.

However, remember that thus far alone we’ve seen over $30 billion in block sales. That’s because the nature of options and SWAPs is that you are able to control far more shares than if you bought them directly.

- depending on the options, up to 100X leverage is possible

The banks that were extending leverage to Archegos had no idea that they were leveraging their positions so aggressively across at least five major banks.

Now, with the prices of several stocks crashing, as much as 53%, and rumors of more block sales coming, it’s possible that we see major banks overreact and sell more shares than is absolutely necessary.

- in a “better to lock in a slightly bigger guaranteed loss today than risk a potentially massively bigger loss tomorrow”

And of course, the financial damage isn’t necessarily limited to just Archegos and the banks that extended it credit.

FactSet is reporting that

“worries the incident could lead to broader hedge fund de-risking and exacerbate concerns about thin liquidity.” – FactSet Research

We saw similar de-risking back in January when GameStop and other popular meme stocks were skyrocketing in a short-squeeze and hedge funds were making hundreds of millions in losses.

In part 2 of this series, coming next week, we’ll explore the critical lessons investors need to learn from examples of high Wall Street drama.

We’ll also learn the ways to make a fortune when Wall Street’s “Smart money” turns out to be very, very stupid.

Want More Great Investing Ideas?

9 “MUST OWN” Growth Stocks for 2021

How to Ride the NEW Stock Bubble?

5 WINNING Stocks Chart Patterns

Why Are Stocks Struggling with 4,000?

SPY shares were trading at $393.72 per share on Tuesday afternoon, down $2.06 (-0.52%). Year-to-date, SPY has gained 5.65%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Adam Galas

Adam has spent years as a writer for The Motley Fool, Simply Safe Dividends, Seeking Alpha, and Dividend Sensei. His goal is to help people learn how to harness the power of dividend growth investing. Learn more about Adam’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| SPY | Get Rating | Get Rating | Get Rating |