Monday saw one of the largest rotations in years as money managers shifted from growth into value stocks. Was this a sign of renewed caution concerning the global economy? Or simply a prudent rebalancing, heading into the fourth quarter.

Despite no apparent news numerous of this year’s best-performing stocks got hammered, many down over 10% or more on the day.

The selling was focused in growth names, especially technology and specifically cloud-based companies. They were both relentless and seemingly insensitive to price or technical levels.

This suggests that it was a mechanical rebalancing led by long/short hedge funds. Seems like the lead managers that stayed on vacation through the balance of last week’s Labor Day came back Monday, looked at their sheets and said, “Whoa, we better rebalance.”

That meant names like Coupa Software (COUP), Service Now (NOW) Trade Desk (TTD) Twilio (TWLO) and Okta (OKTA) which had all been up by 50% or more were hammered, while buying beaten-down banks and cyclicals such as Bank America (BAC) and Caterpillar (CAT) enjoyed their best day in weeks.

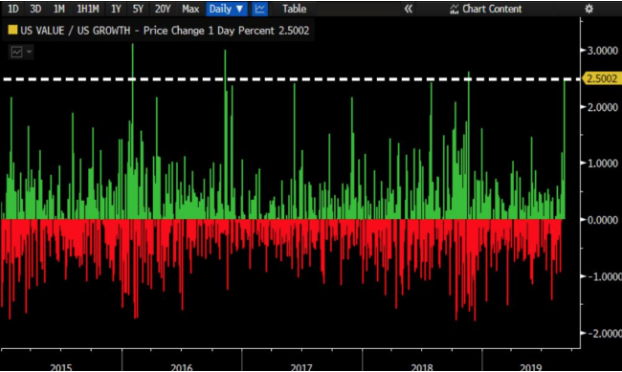

The result was after months of growth (black line) outperforming value (red line) by as much as 15 percentage points for the year to date, the gap was narrowed by nearly 5% in a single day.

As you can see below, the extent of the third type of relative performance or rotation from one sector to another is fairly rare.

According to an article in ZeroHedge, there was chatter is this is forced derisking from momo-tilted funds, faced the equity equivalent of a Value at Risk or VAR shock as momentum, has outperformed so dramatically that they need to be rescaled to risk exposure limits.

The question now is was this simply a prudent rebalancing and ultimately a healthy broadening of the market? Or, a case of losing one of the last remaining leadership groups.

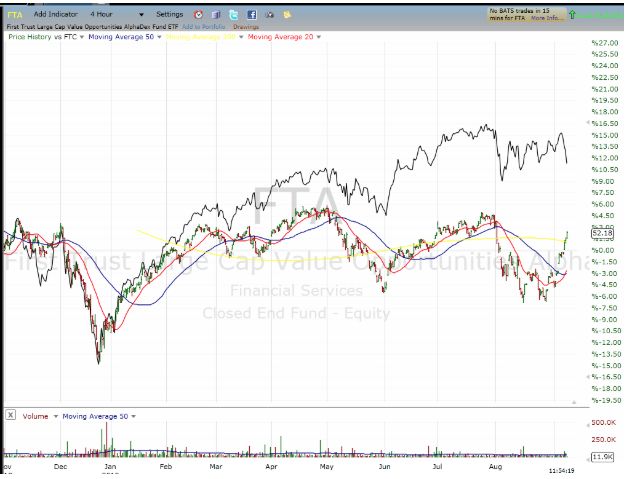

The major indices have been at near all-time highs, despite what’s been a rolling bear market in many sectors such as energy, financials, materials, and transportation.

The first sign that it’s the former would be seeing that growth stocks find some support and price stabilization. We are already noticing that some names like ZScaler (ZS) have already rebounded and most of the cyclicals like Deere (DE) are adding to yesterday’s gains.

This tells me yesterday’s rotation was simply a prudent rebalance of portfolio allocation rather than a shot across the bearish bow. Baring some jarring tariff or other macro news, this sets the market up for a solid run to new highs heading into the end of 2019.

BAC shares were trading at $29.24 per share on Tuesday afternoon, up $0.61 (+2.13%). Year-to-date, BAC has gained 20.71%, versus a 20.10% rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| BAC | Get Rating | Get Rating | Get Rating |