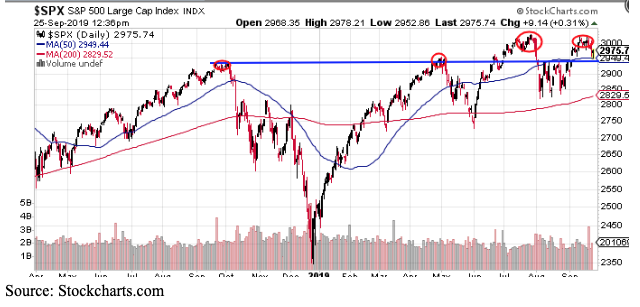

Despite a constant barrage of headline risks, the S&P 500 Index is just 2% from its all-time high. But, that also means it’s essentially where it was 18 months ago.

Granted, it has made three marginal new highs during that period, but each time it petered out. The latest attempt came up short and maybe portend a larger decline to come, but, until it breaks the $2950 level, the long-term uptrend remains in place.

In trying to divide the next move, one must look beneath the hood of the broad index levels and there you will see tremendous turbulence and divergence of among the various sectors.

The most notable issue is a dramatic shift from high growth tech stocks, which drove performance during the first half of the year, into “value” or more defensive issues such as consumer staples, utilities and even some cyclical sectors such as manufacturing and chemicals which had been beaten down.

For example, momentum names such as The Trade Desk (TTD), Twilio (TWLO) and Service Now (NOW) have dropped some 15%-25% in just the past six weeks. Granted, they are all still up some 10% on the year.

More concerning is the fact that FANG has lost its bite with Amazon (AMZN) and Google (GOOGL) basically flat for the year, and Netflix (NFLX) down some 35% from July high and negative year-to-date.

And of course, newly-disappointing debuts of minted IPOs such as Uber (UBER) and Slack (WORK), to say nothing of the WeWork debacle, have shown investors no longer have an appetite for growth at any cost.

On the other hand, some sectors such as utilities, consumer staples, materials and real estate, which all offer dividend yields above current Treasury Bonds, have gained 15% to 20% over the past few weeks.

The drive into defensive stocks is a somewhat logical way for investors to cope with the mixed signals of the possibility of a slowing economy, or even a looming recession, even while economic data remains fairly positive.

The zero interest rate policy (ZIRP) has also distorted what it means to be a “value stock” as these safe havens now trade at their highest P/E ratio ever.

Piling into among defensive issues at these valuations not only might be a folly it’s also going to be a tough way for the overall market to charge to new highs.

Ultimately, these companies simply won’t deliver the growth needed to sustain a new leg higher for the bull market. And they are also the smallest in terms of the market capitalization of S&P 500 sectors; meaning they simply don’t carry enough weight to move indices substantially higher.

The upcoming earnings season could prove crucial; if companies can show growth and profits continue to climb it may signal an “all-clear” for investors to regain confidence. Nike (NKE), as a company in the crosshairs of tariff and consumer spending, issued a strong report last night is a very positive sign.

The stock market often climbs a “wall of worry” and right now there is plenty to worry about. It’s when everyone gets giddy that we’ll really need to worry.

GOOGL shares were trading at $1,240.51 per share on Wednesday afternoon, up $22.18 (+1.82%). Year-to-date, GOOGL has gained 18.71%, versus a 20.62% rise in the benchmark S&P 500 index during the same period.

About the Author: Option Sensei

Steve has more than 30 years of investment experience with an expertise in options trading. He’s written for TheStreet.com, Minyanville and currently for Option Sensei. Learn more about Steve’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| GOOGL | Get Rating | Get Rating | Get Rating |