The auto industry accounts for 4% of global GDP and its share of economic activity is expected to continue growing. According to Statista.com, in 2017 the global industry was worth $5.3 trillion and this is expected to grow to $8.9 trillion by 2030.

Within the auto industry, there are a variety of types of companies: auto manufacturers, car dealerships, auto parts and service companies, etc. Many of these companies have experienced impressive returns over the past couple of years and there’s no reason to think that this momentum should slow down in 2022.

One catalyst for the auto industry is that production is expected to return to full capacity by the end of the year. Due to a global chip shortage, auto production has been running at about 60% of total capacity on a global basis. This is leading to rising prices for vehicles and a shortage of used cars. However, recent commentary from management teams seems optimistic that the situation is improving.

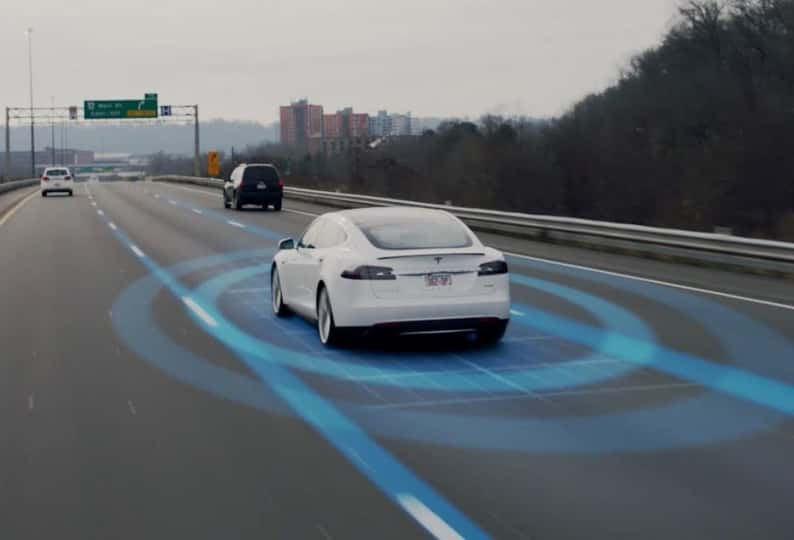

On a longer-term scale, the automotive industry is in the early stages of a massive transformation. Two emerging trends – electric vehicles and autonomous driving – are going to revolutionize the auto industry. In the not too distant future, it’s predicted that the majority of vehicles sold will be powered by electricity, rather than internal combustion engines (ICE). Already, technology like algorithms, connectivity, and cameras are being utilized to make cars safer, and the ultimate end-game is fully autonomous vehicles.

Due to the demand for this new technology and the “return to normal” after the coronavirus pandemic subsides, now could be a great time to invest in the auto industry. In this article, we evaluate 5 companies that we think stand to outperform in 2022: Honda Motor Company Ltd. (HMC - Get Rating), Volkswagen (VWAGY - Get Rating), AutoZone Inc. (AZO - Get Rating), Genuine Parts Company (GPC - Get Rating), and AutoNation Inc. (AN - Get Rating).

Let’s take a look at the auto industry before we analyze these 5 stocks:

History of the Automotive Industry

While the automotive industry officially started near the end of the 19th century, it didn’t take off until Ford (F) created the first Model T in 1913. The car was manufactured on an assembly line, which was considered groundbreaking technology at that time. It made cars more affordable for consumers while allowing the company to scale production without a loss of quality.

Since then, the industry has seen the number of automakers explode with car companies all over the world. Regular cars were joined by trucks, SUVs, and campers. Traveling became more accessible, and cities grew larger due to the automobile. Now the automotive industry includes not only auto manufacturers but also auto parts companies and auto dealers.

Plus, other industries depend on cars for sales. For instance, energy companies produce oil for cars, and almost every industry relies on trucks to get their products from suppliers to stores. There are approximately 1.5 billion cars globally, and that number is expected to grow to 3 billion by 2050.

Electric Vehicles and Autonomous Driving

While the assembly line revolutionized auto manufacturing over a century ago, electric vehicles and autonomous driving are poised to revolutionize the industry in this century. As cars have become a massive part of our lives and an integral part of our economy, they have also done significant damage to the planet by adding billions of tons of carbon into the atmosphere.

Close to one-third of all greenhouse gasses are caused by transportation. Also troubling is that over 1 million people die per year from car accidents. This has led automakers to innovate with electric cars and autonomous driving. So far, Tesla (TSLA) has been the leader in the race for electric and autonomous cars, and there’s no denying its stock has soared along with the growth of the EV market.

Now, virtually all automakers are making investments in these technologies. Some of the world’s biggest automakers, such as General Motors (GM) and Volkswagen (VWAGY - Get Rating), are gearing up to release their lineups of electric cars to stay competitive in what looks like an electric future.

Economics of the Auto Industry

Automotive stocks tend to be cyclical, which means that consumers typically buy less of a product or service if they’re worried about the economy. So, when the economy is declining, there are typically fewer people buying cars. This leads to lower profits for car companies and usually lower stock prices.

However, the pandemic led to a very unusual situation as consumer spending actually increased due to stimulus payments and so many outlets for spending unavailable. At the same time, production has been adversely affected by lockdowns, unavailability of components, and the semiconductor shortage.

As a result, vehicle prices have risen, and there is optimism that production will gradually improve in 2022, boosting the prospects of auto manufacturers and auto parts companies while also leading to some deflation in used car prices.

Automotive Stocks to Buy in 2021

Honda Motor Company, Ltd. (HMC - Get Rating)

Originally a motorcycle manufacturer, HMC was founded in 1948. Today, the company makes automobiles, motorcycles, and power products such as boat engines, generators, and lawnmowers. It also makes robots and private jets. It is currently Japan’s third-largest automaker by sales and has the highest exposure to North America out of Japan’s big three.

The company’s brand and its reputation for quality have helped drive demand for its models. HMC has also been historically known for fuel-efficient cars, which has positioned it to take advantage of consumer demand for more fuel-efficient vehicles. The popularity of its vehicles has also allowed it to use fewer incentives than other automakers, boosting its profits and improving its cars’ resale value.

Like most automakers these days, the company is investing in electric vehicles with its Honda 2030 Vision. HMC has an overall grade of B, which translates into a Strong Buy rating in our POWR Ratings system. B-rated stocks have posted an average annual return of 20.1% which compares favorably to the S&P 500’s average annual performance of 8%.

HMC also has a Value Grade of A, which makes sense with a trailing P/E of 8.0. We also grade HMC based on Growth, Momentum, Stability, Sentiment, and Quality, which you can find here. HMC is ranked #5 in the Auto & Vehicle Manufacturers industry. You can find other top stocks in this industry by clicking here.

Volkswagen (VWAGY - Get Rating)

Headquartered in Wolfsburg, Germany, VWAGY operates in four segments: passenger cars; light and heavy commercial vehicles; power engineering; and financial services. The company owns brands that include Audi, Porsche, Lamborghini, and Bugatti.

When it comes to EVs, most people think of Tesla (TSLA). While TSLA is the leader, most people don’t know that VWAGY is second with a 12% market share. It’s already outcompeting TSLA in many markets and is poised to introduce new EV models and enter new markets in the coming years.

In fact, Deutsche Bank released a report saying that Volkswagen could exceed Tesla in total market share in 2024. It believes that Volkswagen’s EV unit deserves a valuation of $240 billion if it had the same multiples as other EV companies. Its electric SUV is expected to be quite popular based on early reviews and public interest.

The company’s recent earnings report showed some adverse effects from the semiconductor shortage led to lower production and a 4% decline in revenues. However, the company was able to offset this with higher prices so earnings increased by 8%. For 2022, analysts expect $254 billion in revenue and $16.7 in net income. This figure could be upgraded if the semiconductor situation continues to improve as it has in recent months.

VWAGY’s POWR Ratings reflect this promising outlook. It has an overall B rating, which equates to a Buy in our proprietary rating system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

VWAGY has a B grade for Value and Stability. This is consistent with its P/E of 6.4 which is significantly cheaper than the S&P 500. VWAGY’s Stability grade is due to its strong balance sheet, diversified operations, and presence in markets all over the world.

To see more of VWAGY’s POWR Ratings including component grades for Growth and Momentum, click here.

O’Reilly Automotive (ORLY)

As I mentioned earlier, automakers are not the only companies in the automotive industry. Auto parts are also big business. ORLY is one of the nation’s largest auto parts and accessories retailers, with almost 6,000 stores in the U.S. The company sells aftermarket automotive parts, tools, and accessories to do-it-yourself customers in the United States.

In addition to long-term solid industry fundamentals due to the record-high U.S. vehicle age, the company benefits from a strong brand, high customer engagement, and the success of its proprietary label products. ORLY’s leadership standing in the DIY segment has provided a strong national store network that it can leverage to expand DIY sales. The company is also expected to grow through a combination of new store openings and same-store sales growth.

ORLY has also been a beneficiary of strength in used cars and that cars are staying on the road for longer. Currently, the average age of a car on the road is 12.1 years. If used car prices deflate as many expect with the economy returning to normal and increased new car production, then that could be a headwind for ORLY. Another is increasing competition from e-commerce companies like Amazon (AMZN).

AZO has an overall grade of B, which is a Buy rating in our POWR Ratings

system. The company has a Sentiment Grade of A, which means it is well-liked by analysts. According to the StockNews Price Target feature, 9 out of 15 analysts hold a Strong Buy or Buy rating on the stock with none having a Sell rating.

AZO also has a Quality Grade of A due to its healthy balance sheet and status as one of the leading companies in the auto parts sector. It’s also been a long-term outperformer with more than a 1,000% gain over the last 10 year. Click here to see more of ORLY’s POWR Ratings including component grades for Growth, Value, Momentum, and Stability.

Genuine Parts Company (GPC - Get Rating)

GPC distributes automotive replacement parts, industrial parts, and materials. The company distributes automotive replacement parts for imported vehicles, hybrid and electric vehicles, trucks, SUVs, motorcycles, and recreational vehicles. It operates across the U.S., Canada, France, Australia, and internationally.

A major catalyst for companies supplying parts to the auto industry like GPC is that auto production is expected to increase by more than 50% over the next couple of years as supply chain challenges ease. Already, automakers have noted in earnings calls that challenges remain, but the situation is rapidly improving.This should lead to a nice tailwind for GPC’s earnings growth over the next couple of years.

For 2022, analysts are forecasting $7.35 in EPS and $20 billion in revenue which implies 9% and 7% growth, respectively. Even with this growth, GPC remains cheaper than the market by a slight degree with its forward P/E of 17 vs 19.5 for the S&P 500. GPC also pays a higher dividend yield at 2.5% vs 2% for the 10-year yield on the S&P 500.

GPC’s strong fundamentals are reflected in its POWR Ratings. The stock has an overall A rating, which indicates a Strong Buy in our proprietary rating system. A-rated stocks have posted an average annual performance of 31.1% which compares favorably to the S&P 500’s average annual 8% gain.

Within the Auto Parts industry, GPC is ranked #2 of 65 stocks. Click here to see GPC’s complete POWR ratings including component grades for Value, Growth, Quality, Momentum and Sentiment.

AutoNation Inc. (AN - Get Rating)

AN is the largest automotive dealer in the United States, with over 230 dealerships. The firm also has five AutoNation USA used-vehicle stores and 81 collision centers all across 16 states, primarily in Sunbelt metropolitan areas. The company also sells used vehicles, parts, and repair services, as well as auto financing.

The company has recently refocused its efforts towards new initiatives, including standalone used vehicle dealers, expanded collision centers, and branded aftermarket parts. In addition to the current five, it plans to add 95 more AutoNation USA used vehicle stores by 2030. With more used-vehicle stores, the company can retail more of its used-vehicle trade-ins instead of dumping them into auctions where it loses money.

The company also has a very cheap forward P/E of 6.0. This means that the stock has already discounted a drop in used car prices. It’s also possible that used car prices don’t drop as much as expected due to inflation

AN has an overall grade of A or a Strong Buy rating in our POWR Ratings service. The company has a Growth Grade of B which is consistent with expectations of 25% earnings growth next year. AN’s investment in Waymo also gives it more upside and exposure to the autonomous driving segment.

For more of AN’s grades such as Value, Stability, Sentiment, and Quality, click here. AN is ranked #5 in the B-rated Auto Dealers & Rentals industry. For more top stocks in that industry, make sure to click here.

Want More Great Investing Ideas?

VWAGY shares were trading at $28.08 per share on Thursday afternoon, down $0.85 (-2.94%). Year-to-date, VWAGY has declined -3.84%, versus a -7.98% rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles. More...

More Resources for the Stocks in this Article

| Ticker | POWR Rating | Industry Rank | Rank in Industry |

| VWAGY | Get Rating | Get Rating | Get Rating |

| HMC | Get Rating | Get Rating | Get Rating |

| AZO | Get Rating | Get Rating | Get Rating |

| GPC | Get Rating | Get Rating | Get Rating |

| AN | Get Rating | Get Rating | Get Rating |