2 Undervalued Growth Stocks You Should Buy During the Trade War

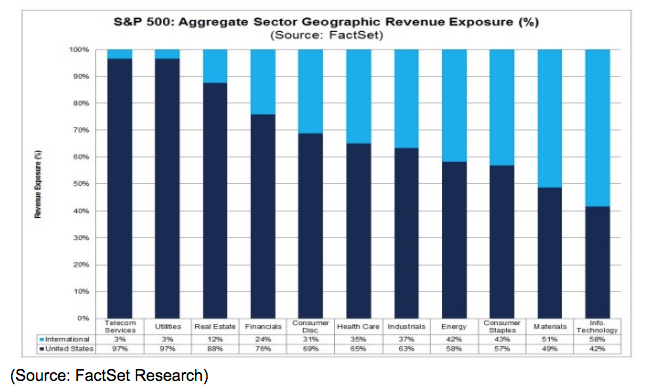

For months now the market has been wracked with worries over America’s escalating trade war with China. 12.5% tariffs are already in place on half of Chinese imports into the US and are set to double to 25% on January 1st. And with the Trump administration threatening to impose up to 25% tariffs on another $267 billion in Chinese imports (effectively all of them), the threat to global growth, as well as corporate profits, is severe.

But such periods of elevated risks are always opportunities in disguise. That’s because the market is always climbing a wall of worry over something, and today the trade war is just one brick (though the biggest one) in what stands between stocks and new record highs. And the good news is that we’re getting reports that a breakthrough that ends the trade war might be just days away. That means that today is potentially a great time to buy two especially trade sensitive dividend growth blue-chips, Apple (AAPL) and A.O Smith (AOS). These undervalued stocks are potentially coiled springs poised to rocket higher as soon as even a handshake deal is announced. And from today’s prices, that means market-beating total returns of 15% to 17% over the coming years.

Why The Trade War May Be Ending Relatively Soon

Friday and Saturday (November 30th and December 1st) is the G20 meeting in Buenos Aires, Argentina. The most important meeting between world leaders will be between President Trump and Chinese President Xi Jinping. That will be over a working dinner where both men will discuss the escalating trade war. Ahead of the meeting US and Chinese trade negotiators have been hammering out an outline for a working agreement to end the trade war once and for all. President Trump has indicated he’s looking to cut a deal and even ordered administration officials to draw up official paperwork that could allow him to end the tariffs in short order.

Now it’s important to note that analysts and trade experts are NOT expecting an official end to the entire trade conflict at this meeting. Rather we’re looking for a handshake deal like what Trump stuck with the EU that prevented over tariffs on over $300 billion in European imports (mostly to the US auto sector). The idea is that the two men can announce a “deal to make a future deal” that prevents 25% tariffs being imposed on all Chinese imports into the US.

Here, let me elaborate further…

Click on the Next Page to Continue Reading

None other than Larry Kudlow, Trump’s top economic advisor has expressed optimism about just such a deal saying on November 27th that, “There’s a good possibility we can make a deal…President Trump has indicated he is open – now we need to know if President Xi is open.” And on November 29th Trump said he was “close to doing something with China on trade.” Further good news is that Peter Navarro, the most hawkish trade warrior in the administration, will, according to Reuters, now be attending that Saturday working dinner meeting. Earlier he had said he would not causing some analysts to be skeptical that any major breakthrough could be reached. With Navarro now in the meeting, that means the dinner table will literally be set for the very handshake deal that Wall Street has been praying for.

While there remains a lot of uncertainty surround that Saturday dinner meeting, there is also cause for optimism. That stems from the fact that China’s economy has been slowing in recent years, hitting its slowest growth rate in a decade last quarter (and expected to keep slowing into next year). That wasn’t all from the trade war since thus far US tariffs on Chinese goods have largely been offset by the falling Chinese Yuan. Rather China’s been facing a contracting labor force since 2014 (due to its decades-long one-child policy, now revoked), and the government’s efforts to reduce economic growth dependence on debt.

However, the growth rate has now slowed to near the 6% limit the government considers dangerous for political stability, and thus Beijing has ordered state-owned banks to reverse course and deploy over $150 billion in extra lending as a form of stimulus. And keep in mind that the US threatened 25% tariffs on $200 billion in imports that go into effect January 1st means that China’s growth headwinds are only mounting. 25% tariffs on all Chinese imports to America would be an even bigger blow, and Trump has indicated that should no deal be struck soon, then he could announce the final $267 billion round of tariffs mid-December. The 90 day comment period means those would go into effect mid-February.

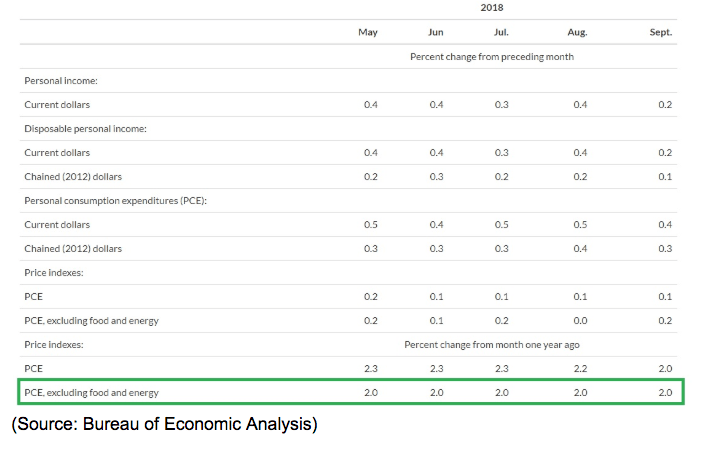

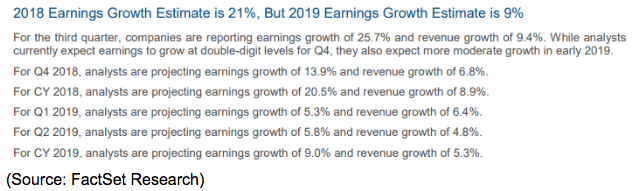

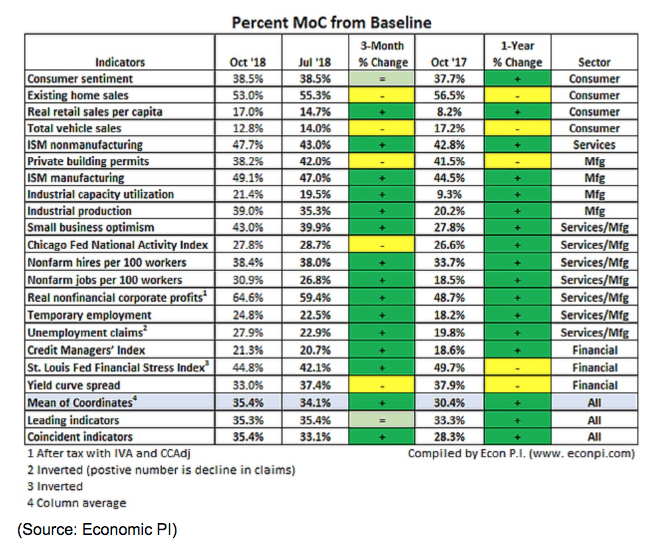

3What about the US perspective? Well, President Trump has certainly been aggressive in his stated belief that a “trade was is good and easy to win”. However, the reason that he’s been making more overtures to resolving the trade war is that the strong US economic growth he was expecting to let America ride out this conflict is now fast losing steam. In Q2 GDP grew 4.2% and 3.5% in Q3 (second estimate just released from the Burea of Economic Analysis). Q4’s growth estimates, based on leading economic indicators and economic reports have not been promising.

Here’s what I mean by that…

Click on the Next Page to Continue Reading

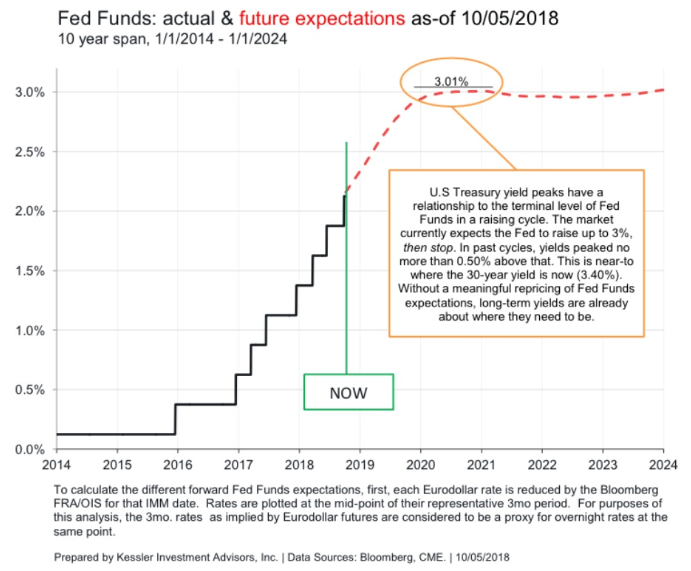

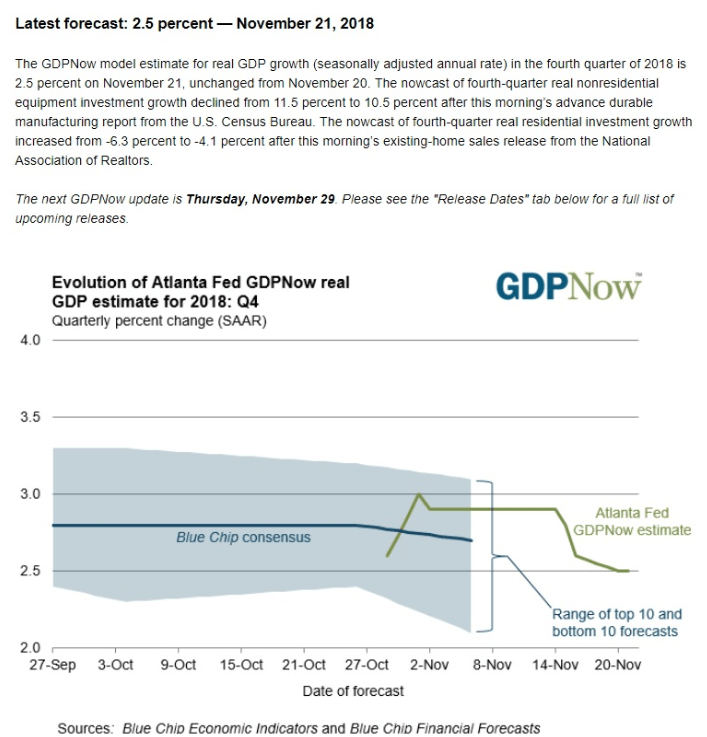

The current economist consensus is that America’s economy will grow just 2.6% this quarter, and the usually optimistic Atlanta Fed’s GDP now model say 2.5% growth is likely. That agrees with the New York Fed’s Nowcast which also calls for 2.5% growth.

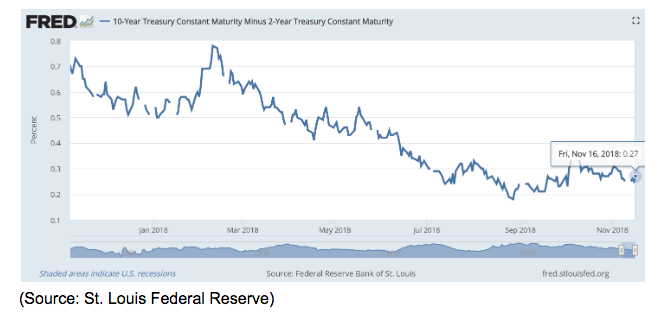

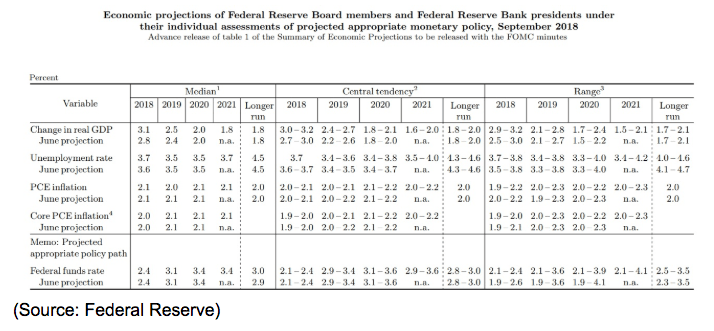

Keep in mind that 2+% economic growth is still good, and not indicative of a coming recession. But the point is that 2018 was expected to be a very strong growth year for the US, with growth slowing to just 2.5% in 2019 and 2.0% in 2020 (due to fiscal stimulus wearing off). For growth to slow to 2.5% this early, and before US tariffs on Chinese imports are really even taking effect, is a worrying sign to economists, analysts, and administration officials. Goldman Sachs even believes that if the trade war continues all 2019 that US GDP growth will continue falling, hitting 1.6% in Q4 2019.

The Federal Reserve (and most economists) expect 2.5% GDP growth next year, 2.0% in 2020 and growth to finally bottom at 1.8% in 2021 and beyond. If the trade war reaches its maximum point (25% tariffs on all Chinese imports) and Goldman Sachs is right, then US growth could fall to levels significantly below even these highly conservative estimates, and two years ahead of expectation to boot.

Remember that President Trump is running for re-election in 2020 and his entire campaign strategy is to run on peace and prosperity that results from his promise to deliver “great deals” on trade and tax cuts. The tax cut stimulus is now over and done with, and so without a trade deal that removes the economic anchor that tariffs represent, his political life could be on the line if the US economy is growing under 2% in 2020.

Here are my thoughts on it…

Click on the Next Page to Continue Reading

No matter what you may think of Trump, or his difficult to follow political calculations, there is one thing I’m confident of. This is that he, like all politicians, are always looking to maximize their own political survival. The current global/US economic climate, in addition to the stock market’s recent correction (largely driven by trade war fears), is creating ever large pressure to cut a deal soon. No, a final resolution won’t be announced at the G20, but a handshake deal to prevent the worst effects of the trade war could. And even if such an agreement can’t be reached, simple economic realities mean that in early to mid-2019 at the latest, both the US and China are likely to be forced to end the tariff war. If only because not doing so would threaten the political futures of both Xi and Trump.

So, how can you profit from the potential end of the trade war in the coming weeks or months? By buying Apple and A.O Smith, two undervalued blue-chips poised to soar when such a deal is announced.

2 Great Undervalued Dividend Growth Stocks You’ll Want To Buy Before The Trade War Ends

Apple (AAPL)

Yield: 1.6%

Estimated Fair Value: $200

Discount To Fair Value: 10%

10 Year Analyst EPS/Dividend Growth Consensus: 13.1%

10 Year CAGR Total Return Potential: 15% to 16%

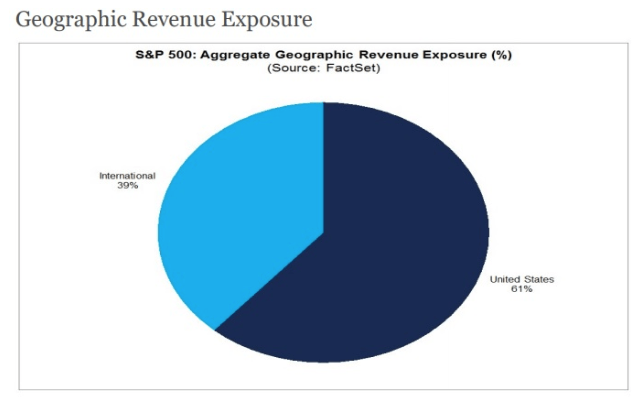

Apple’s plunge into a bear market actually had nothing to do with the trade war at all. That’s because while iPhones are assembled in China, thus far Tim Cook was able to negotiate a complete lack of tariffs on the US side. Similarly, China has not imposed retaliatory tariffs on iPhones, which is why Apple’s sales in that country continue to grow at double-digits.

So what makes Apple a potentially great trade sensitive coiled spring ahead of a potential trade deal? The fact that on November 26th President Trump specifically singled out Apple as an example of the kind of 10% to 25% tariffs that might be put in place in the coming months. That would mean that iPhones, whose average selling price is already at an all-time high, would become 10% to 25% more expensive for US consumers. Or alternatively, the company could just eat the tax and see its margins take a big hit. Bernstein’s Toni Sacconaghi estimates that 25% of Apple total revenues could be subject to the threatened tariffs, which could potentially result in a $1.5 billion to $3.8 billion hit to Apple’s profits. That equates to a 2% to 6% hit to the bottom line which would be significant given that next year analysts are expecting about 10% earnings growth from the company.

Worse is that if China did finally retaliate with tariffs on its own against Apple then the disruption to its supply chain might be even more damaging than the tariffs because they would affect products sold all over the world.

Here’s what it means for Apple…

Click on the Next Page to Continue Reading

So you can see that Apple stands to benefit immensely if the trade war ends, or merely even de-escalates. And keep in mind that the main reasons behind the recent price crash (speculation that iPhone XR was a flop) have been debunked by the company. On November 28th, Greg Joswiak, Apple’s VP of product marketing told Reuters,

“Since the iPhone XR became available, it’s been the best-selling iPhone each and every day that it’s been on sale.”

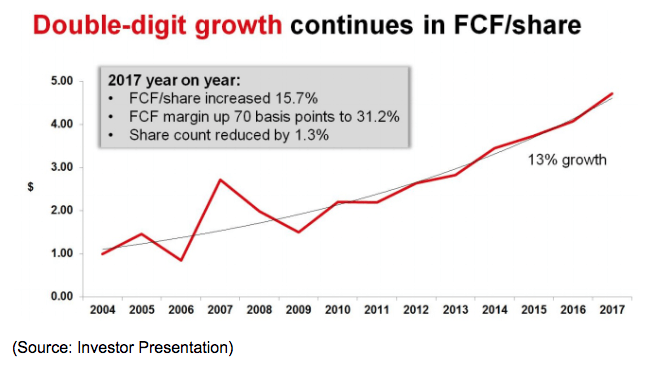

That bodes well for the company being able to achieve analysts long-term and realistic mid-single digit revenue growth and 13% EPS growth (driven by epic share buybacks from $123 billion in net cash and over $50 billion in annual post-dividend free cash flow).

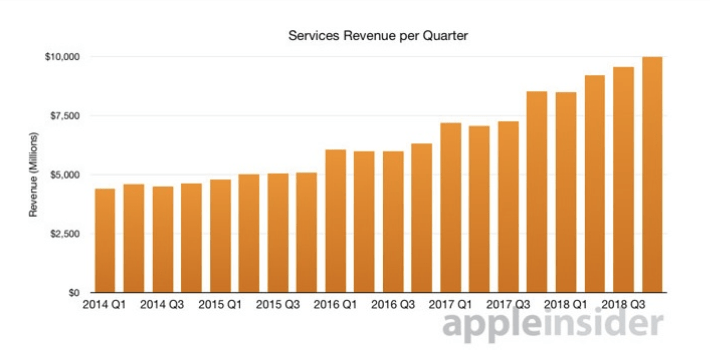

And keep in mind that it’s not iPhone growth that’s going to be the main driver of that sales and earnings growth, but services.

In 2017 Tim Cook stated the company’s goal was to hit $50 billion in annual service revenue (recurring subscription based and high margin) by 2020. Thanks to four years of about 30% annual growth service revenue are now at a $40 billion annual run rate putting the company well on track to crush that guidance.

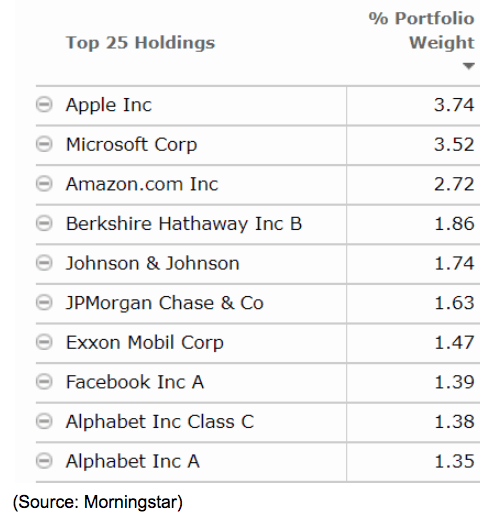

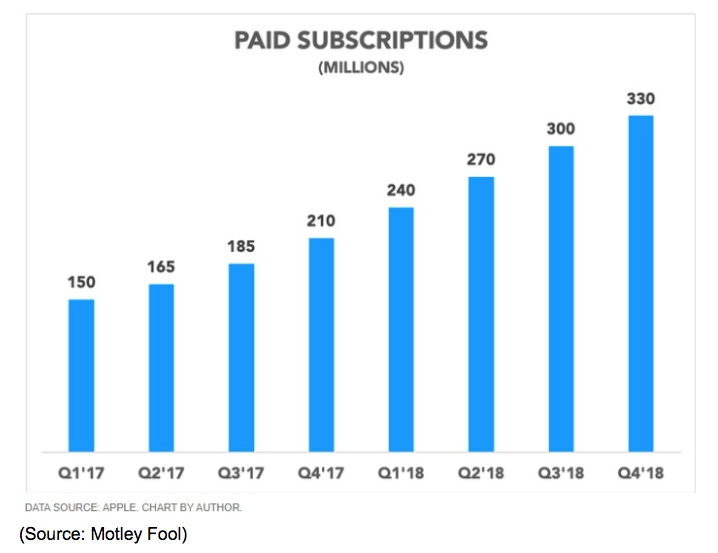

That’s thanks to Apple effectively monetizing its 1.3 billion iOS device user base and converting that in more monthly subscribers than there are people living in the US.

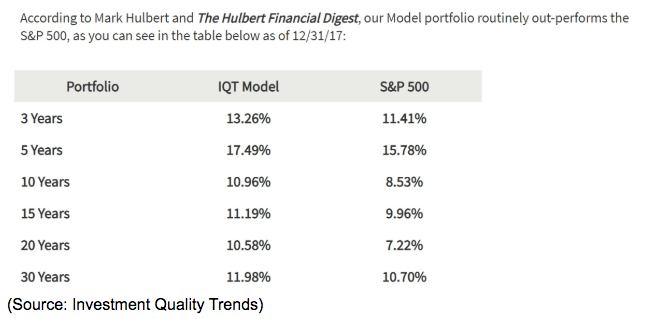

By 2023 Morgan Stanly’s Katy Huberty, who has accurately predicted service revenue growth for the last six straight quarters, estimates that Apple Music alone will have 164 million subscribers. And service revenue over the next five years is expected to nearly triple from $37 billion in 2018 to $101 billion. As a result, Morgan Stanley estimates Apple’s EPS will grow by 20% annually over the next five years. But even if you use just the current analyst consensus (13.1% growth rate) that still equates to Apple delivering 15% to 16% total returns, or roughly double what the S&P 500 is likely to deliver, in the coming years. That makes this low-risk dividend growth blue-chip a fantastic buy today, ahead of the potential end to the trade war.

Here’s another one to keep an eye on…

Click on the Next Page to Continue Reading

A.O Smith (AOS)

Yield: 1.9%

Estimated Fair Value: $79

Discount To Fair Value: 40%

10 Year Analyst EPS/Dividend Growth Consensus: 9.9%

10 Year CAGR Total Return Potential: 17%

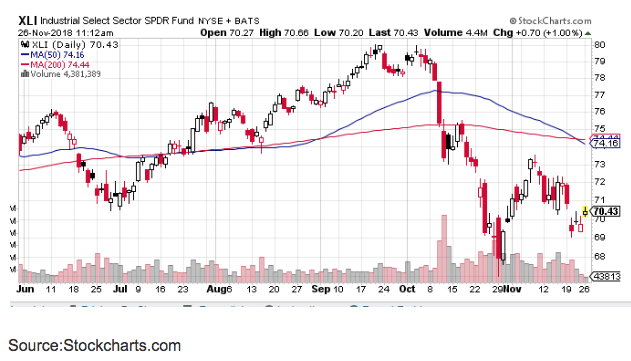

A.O Smith is an industrial dividend aristocrat and thus its share price has been battered in recent months by both fears of a slowing economy as well as the trade war. That’s because of A.O Smith, a leading producer of water heaters and air/water purifiers, is extremely exposed to China.

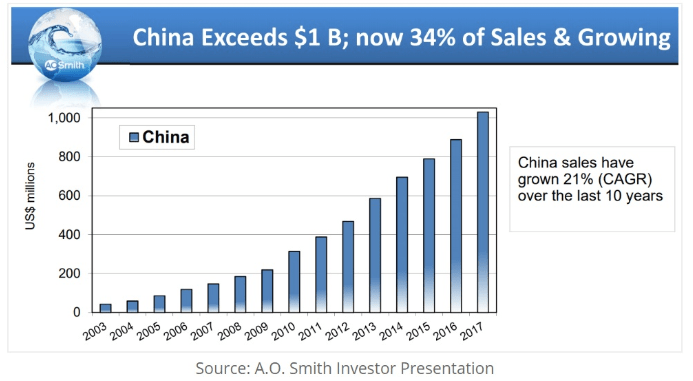

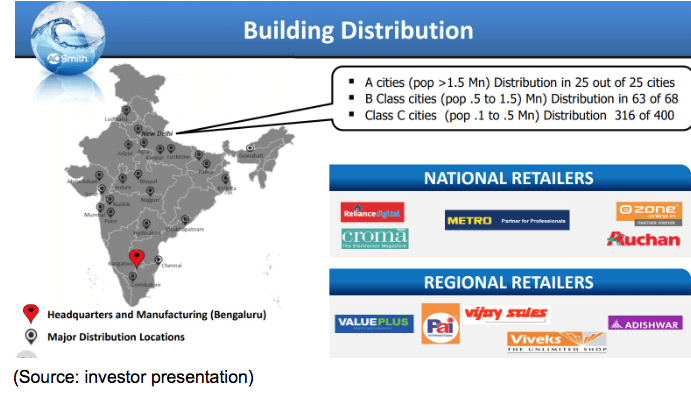

The company entered China’s market back in 2003 and has done a masterful job of establishing a 9,000 strong distributor network in 30% of China’s largest cities and 70% of its medium-sized cities. That’s fueled 21% sales growth which means that today over $1 billion or 34% of the company’s revenue comes from the middle kingdom.

But now with the trade war threatening its biggest growth market, (and slowing China’s economic growth), Wall Street is terrified that A.O Smith’s best growth days are behind it. But what the street is missing is that A.O Smith isn’t just the best way US dividend investors can profit from China’s growth, but India’s as well.

In fact, A.O Smith is my favorite dividend growth stock set to profit from the massive growth in both China’s and India’s middle class. A.O Smith set up its first office in India in 2008, began making and selling water heaters in 2010, and then water/air purifiers in 2015.

What does this mean for the markets?…

Click on the Next Page to Continue Reading

It’s fast building a leading network across that country’s largest cities, as well as smaller urban markets. That includes partnering with top national retailers, the Home Depot and Lowe’s of India. And given that India’s middle class is expected to reach 273 million households in 2020 and 322 million in 2030, A.O Smith has a massive growth runway ahead of it. In 2017 India sales (less than 1% of the company’s total) grew at 44%, signaling the company might be able to recreate its earlier Chinese success in that even larger potential market.

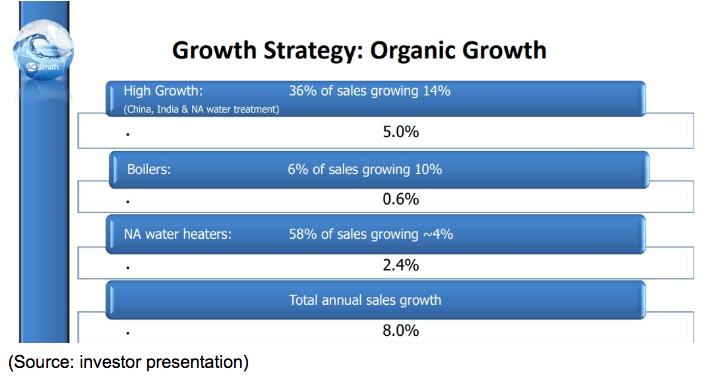

The combination of China and India is expected to help drive 8% long-term organic sales growth, which analysts expect to translate into 10% EPS growth over the long-term, even factoring in the current trade war (which will have to end eventually).

That doesn’t sound like much BUT when you factor in the company’s dividend and it’s current 40% discount to fair value you get the potential for 17% total returns over the coming decade. That’s more than double what the S&P 500 is likely to deliver, and from a low-risk dividend aristocrat (25 consecutive years of dividend growth) with a fortress-like balance sheet no less.

Bottom Line: Times Of High Market Volatility And Fear Are The Perfect Time To Buy Grade A Dividend Growth Stocks At Bargain Prices

While it’s far from guaranteed that we get a handshake agreement to end the trade war on Saturday, the fact is that both the US and Chinese economies are starting to feel the growing negative effects of escalating tariffs. Thus both Trump and Xi have strong incentives to at least announce a “deal to make a future deal” that prevents even further damage, such as 25% tariffs on another $267 billion in US imports from China next year.

If a deal is struck, either this week or soon after, then Apple and A.O Smith are poised to rocket higher, far off their recent bear market lows. And given the Grade A nature of both of these blue-chips, that makes today a great time for value-focused income growth investors to buy these coiled springs before they pop. And if a deal isn’t struck? Well then the low valuations of both stocks mean there is relatively little downside risk in the short-term, compared to the massive upside potential you can lock in by investing in both companies today.