Will Zuora (ZUO) Continue Up the Comeback Trail?

Zuora (ZUO) “provides cloud-based software on a subscription basis that enables companies in various industries to launch, manage, and transform into a subscription business.”

Basically, Zuora helps legacy businesses move from a single sale to what in the software world is known as a ‘software as a service” or SAAS model. It worked for huge companies like Microsoft (MSFT) and Adobe (ADBE) and I imagine it is working for many smaller companies that need 3rd party back end support. This is a hot trend, and the company is acquiring new business at a rapid pace with year-over-year revenues growing 47%+ over the past six quarters.

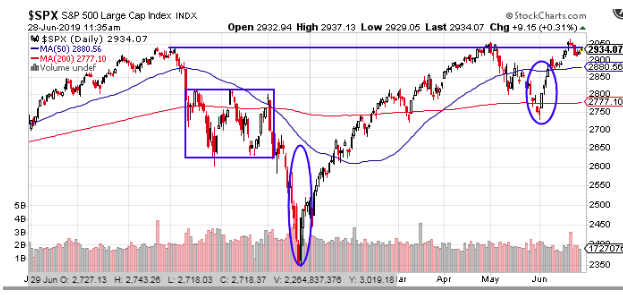

Then disaster struck when during the last earnings call in May when the company posted lower-than-expected numbers with a significant slowdown in sales and lowered guidance. Management said the company needs to improve on sales execution. But, despite expanding its strategic sales team in the last year, it forecasts weaker second-quarter performance. New sales staff are half as productive as experienced staff. With revenue growth failing to offset the growth related to higher staff costs, investors need to wait patiently before the business re-accelerates.

That uncertainty sent the stock plunging by some 30% on that single day. However, it is slowly starting to make a come back.

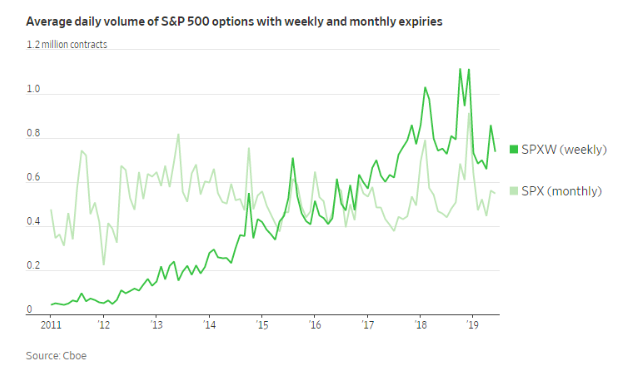

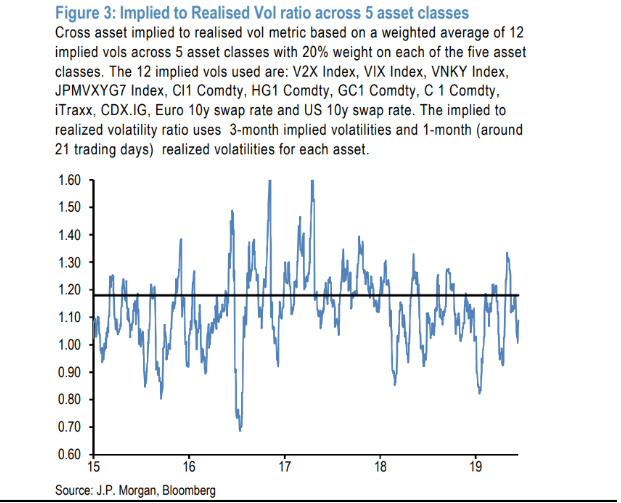

The options are fairly liquid (it helps they are only monthly so volume isn’t splintered among too many strikes and expirations. But, that’s another discussion) and implied volatility is in the lower 5th percentile in ZUO’s 10-month history, making the outright purchase of calls a good leveraged play.

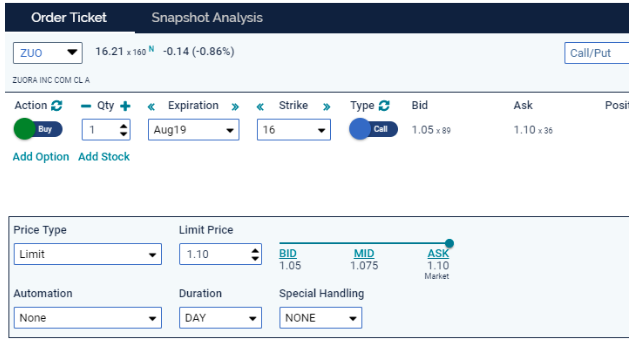

-Buy to open ZUO September 16 strike Calls at $1.10 per contract

This allows a few months for the stock to continue climbing, and it also includes the company’s next earnings even on Aug. 29. This means the calls will not only retain their value leading up to the release date but also provide an opportunity for the company to redeem itself and send shares sharply higher.